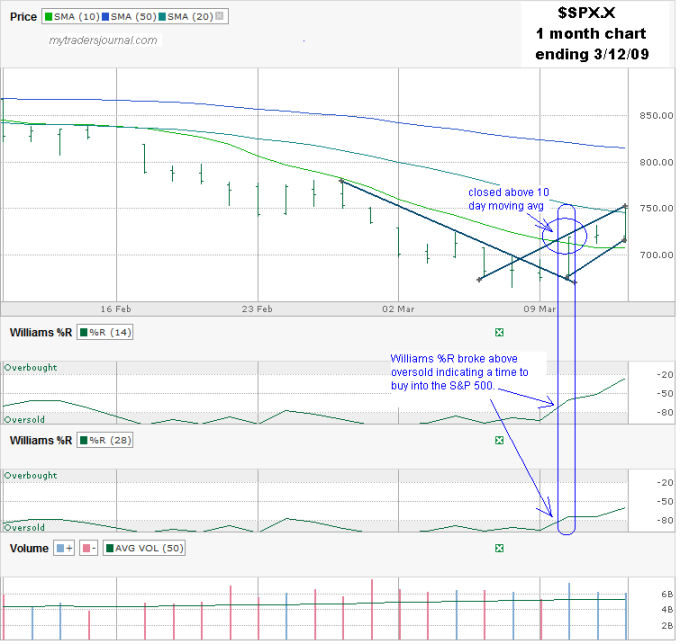

My favorite technical indicator lately is Williams %R. I’ve been writing a lot about it lately saying we should all watch it to be ready to pounce. I was hesitant on Tuesday to believe the 28 day indicator would stay up. On Wednesday I still didn’t see enough of a clean break above Williams %R oversold to make me get over my fear. Today I came to grips with the fact that I should’ve made the move and bought in deeper to the S&P 500 when it was making its initial move on Tuesday.

I almost bought back my long puts on SSO every few hours while I had a profit, but never did and now I have a paper loss. At least I’m still hedged against my short puts. Even after all that I want to see the SPX close above 750 before I am a true believer that this bear market rally has more legs than these three days. Friday will be telling. At a minimum we have a new trading channel forming that could end up being something to follow. On Tuesday the SPX closed above its 10 day moving average. Wednesday it confirmed that wasn’t a fluke. Today it closed above its 20 day moving average. If that holds tomorrow (along with staying above 750), the next target could be the 50 day moving average. I’m waiting to see how tomorrow morning opens to decide if I should open my SSO exposure more. With Williams %R still showing momentum moving higher, the best trade could be not to fight it.

Looks like a good short term indicator. Longer term direction hasn’t been decided in my opinion.

This is certainly a short term indicator. I used 14 and 28 day intervals, so conditions outside of that range are anyone’s guess.

I’m glad to see the S&P 500 rebounding. It could be that the days of great buying opportunities are coming to an end. On the other hand, it’ll be nice to check my 401(k)’s account balance and not want to cry.