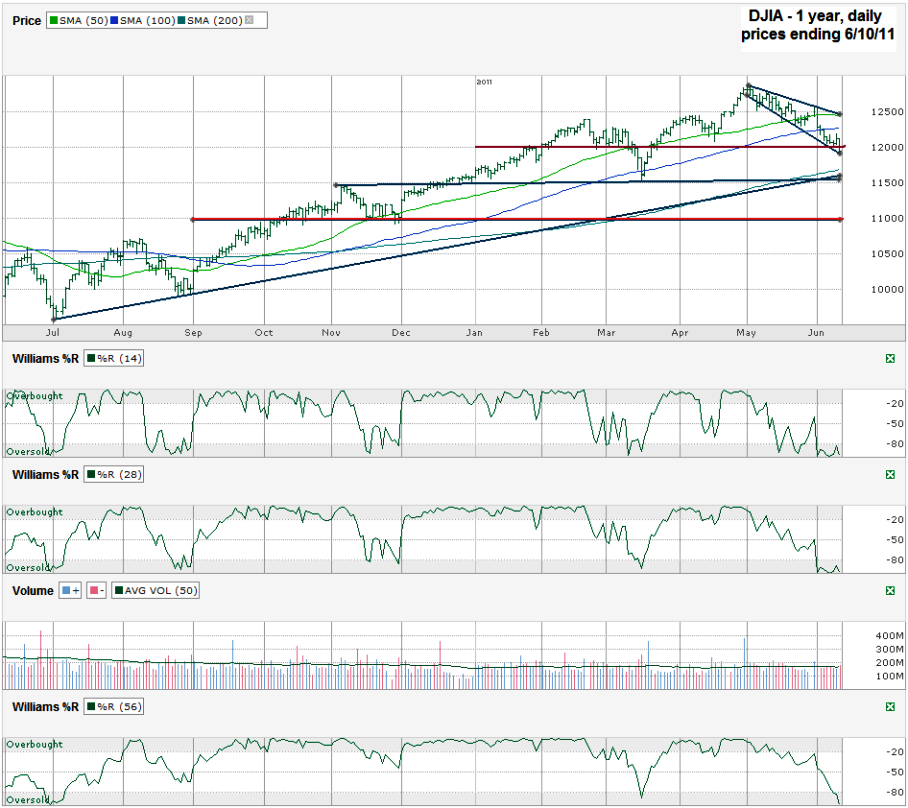

I charted daily prices for the past six months on the Dow Jones Industrial Average ($DJIA, $INDU, $DJI) after it closed on Friday, June 10, 2011 at 11,951.91. A couple of weeks ago when I charted the Dow Jones I said to expect support to come in strong for the DJIA after about 10% of a correction. That was based on the 200 day moving average (dma) sitting around 11,500 at the time. As of Friday the 200 dma is up to 11,687, only another 2% or so from Friday’s close. After six straight weeks of declines another week and 2% might be all that’s left in this for the bears’ turn at the wheel.

On the other hand, it’s hard to call for an upside shoot quite yet though since the technicals aren’t giving us any clear indication that the worst days are behind us. As I mentioned a few weeks ago I like to watch the 56 day period for Williams %R for bigger/longer moves. It was starting to break when I warned last time and now it’s all of the way down deep into oversold territory. I repeat this all the time for any new readers, the trigger isn’t that it’s oversold – we’ve seen the indexes stay oversold for long periods in the past. The real trigger to know when to buy back in will be when these three periods (14, 28 and 56) move above the grey area. For now, none is giving a hint that day is coming soon. Of course when the change comes it’ll probably snap back so this is no time to take a nap.

The 10 and 20 dma are not even on this chart since they aren’t helping right now. They’ll both be included again when it looks like the 20 dma has a chance to move back above the 10 dma in the very near term. So far, the 50, 100 and 200 dma are in a comfortable order to not set off any alarms. That leaves us with trend lines to examine for some insight on what’s to come. The shortest trend line of lower lows that started at the beginning of May marks the bottom met on Friday. It’s steep enough that each day could hug this line and the losses could keep mounting up, but with such a steep line it’s not destined to last too long. The upside from this mini trading channel is almost 500 points higher, but before getting to that we need a catalyst in addition to the 50 and 100 dma need to give up resistance.

Instead of focusing on upside potential right now I think more investors are worried about downside risks and where we might find support. Since the 12,000 line broke on Friday we have to see if the DJIA can recover on Monday. Each day the Dow stays below 12,000 makes the chances of a quick snap back higher less likely. We could see another 450 points to the downside before we find good support. Unless the 200 dma mentioned above does the trick. Support around the 11,500 horizontal line would equal an 11% correction from the intraday high reached at the beginning of May. It’s also the same area of support found in the March correction and was resistance in November 2010 and then resistance and support in December. This line is crucial. If it breaks then the Dow will have fallen below its 200 dma enough to trigger more sellers who base their decisions almost solely on the 200 dma.

Beyond 11,500 the next stop could quickly be 11,000. A fall this far would be a 15% correction. By the time the Dow makes it 950 points lower than Friday’s close the P/E ratio for the underlying stocks would average less than 12. (It’s only 13 now.) Don’t forget we have not seen a collapse of earnings yet. We just think the pace of growth will slow down. A flattening of earnings growth or any growth at all should prevent any more deterioration in the index and bring in value buyers.

It’s looking pretty bad these days. June expiry is gonna be a big loser for me. I’ve currently got 11 losing positions. I’ll need to keep a particularly close eye on RIMM with earnings after the close today.

I have some dogs too. UCO, JPM, DSX and ITRI are up there in the race for ugly. I just closed my June 50 SSO put and will have my post up soon as I can get to it.

Yeah. It’s been a long downward slope for the S&P 500 this past couple of months. I see QCOM is pretty low at the moment. Are you considering getting back into it when your 30 days is up – as you’d originally suggested?

I’m in a few of your names too unfortunately – together with NUE, TBT, CSCO and AEM.