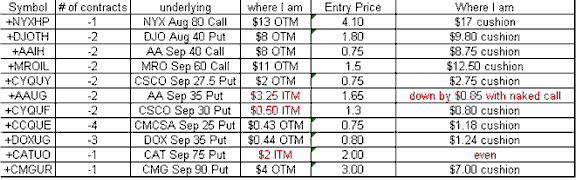

I’m taking some serious losses on paper this week. When this happens I go back and review what I have and where it is in a profit/loss view. Do I have room to handle the roller coaster or not? In this case I found I do. This is a very crude look at what I have in play now, not counting the beatings I’m taking on my long NYX and MRO positions. The labels could be better, but I’m sure you can get the point. (OTM = Out-of-the-money, ITM = In-the-money)

I’m actually only down on one position, AA. Luckily (or is it skill, ha ha), I sold a naked call on AA before it started falling. That has allowed me to cut my losses some. What seemed like big losses I was sure to take are now maybe only rumors of losses. I’ve been suggesting selling well OTM for a couple of months and this is exactly why. As expiration draws closer, these premiums will plummet, assuming the underlying stock doesn’t fall much deeper.

If you didn’t notice, since my VIX post yesterday, it’s up over 33 today, a new four year high again. That’s caused my CMCSA puts to go up in value although the stock has gone up. Insanity is running the show for a little longer apparently.

I sold more CSCO puts this morning at open. The limit order I put in yesterday hit today for two September 30 puts (CYQUF) and I received $248.50 after commissions. Now I have four puts against CSCO in September including the two at 27.50.

Technorati Tags: naked puts, investing, stocks, options, covered calls, options strategies, trade

1 thought on “How Bad Are My Losses”

Comments are closed.