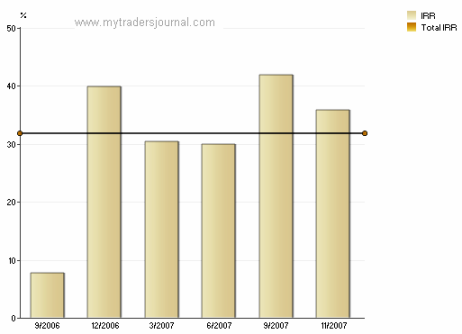

I thought this was cool. Last night I went back for the past six quarters (it’s counting up through yesterday, 11/6, as this quarter) in Quicken and charted my average annualized return per quarter. The quarter ending 9/06 is when I first started getting back into selling options after focusing in on family and my career and trading for a year on Intrade’s predictive markets. I charted the monthly returns at first and they were all over the place. I only had to go to a quarterly view to see it really level out a good bit.

I’m sharing this because I think it’s important for investors, especially those just beginning to use options, to realize that each month is less important than the longer periods. The quarter ending March 07 is when I had my surgery so that makes sense that I had a slow quarter then since I eased up a little before going under the knife. I also like to think the following quarter ending 6/07 was under my average since I was pretty doped up that first month after surgery.

Check out the quarter ending 9/07. That’s when we finally had a correction in the market. Most people who fear selling naked puts might think that would have been my worst quarter with the DJIA dropping 10%, but it was my best because I did not panic and sold puts during that period of increased volatility. Also, I wasn’t overextended going into the correction which emphasizes the need to not get greedy and not to sell puts for more than two times the value of the underlying stocks.

My last theory with all of this will be tested soon. I’ve had an incredible year for deposits to my account. We’ve cut our spending tremendously and have poured everything into this trading account. Now that my balance is over $80k each new deposit will mean less to my account on a percentage basis. My theory is that my monthly deposits have potentially skewed my returns, not in my favor. A $3,500 deposit in January 07 would have been a 10% change in my account balance. The same deposit today would be less than a 5% change. I’ve had to push to make use of the new money flowing into the account, but with a more solid base now I can plan better.

Thanks for sharing, Have you look at poweroptionopt or ivolatility service for selecting coverd call or even naked puts? ivolatility has good blog also.”http://www.ivolatility.com/roller/page/trader”. and for “poweroptioopt “http://blog.poweropt.com/”