I am caught up once again. I dealt with all of my problem children within the first hour of trading this morning.

- I sold all of my DOX shares at 32.47. I won’t be surprised if it rebounds, but it was below where the chart said it should be and the premiums weren’t worth working it deeper.

- I sold all of my GM shares. I learned a lesson with this trade. I didn’t like the stock when I first sold naked puts on it, but thought it would climb. When it did climb I should have treated it as a trade and dumped for a shorter-term profit. That ended up being a $1500+ mistake from what could’ve been to what was.

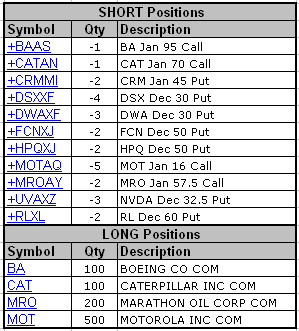

- I covered my MRO shares with two calls out of the money. When MRO was trading at 56.55 I sold two January 57.50 calls (MROAY) and received $748.50. This brings me back to a paper profit, again.

- I covered my CAT shares out of the money. When CAT was trading at 68.85 I sold one January 70 call (CATAN) and received $314.25 after commissions.

- I covered my MOT shares in the money. When MOT was trading at 16.39 I sold five January 16 calls (MOTAQ) and received $511.12 after commissions.

I kept the three stocks that I wrote calls on because I don’t mind owning the shares still at these reduced prices when I can continue to write calls for good premiums. From a previous lesson learned I cut my losses on stocks I didn’t like and didn’t try to chase them down with new calls when technical support had broken. As a new lesson learned, I should have entered limit orders on some of these stocks to sell calls sooner than today to try to get better premiumes once I knew they’d be assigned.

My current holdings are listed below as I’m back to the positive side in cash in my account, including the $40k in a money market.