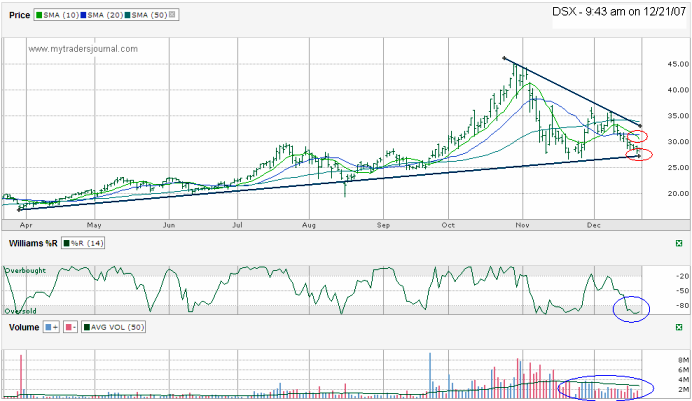

I’m short four DSX December 30 naked puts. DSX is trading at 28.13 as I write this before 10:00 am on the last day to trade these contracts. With as many stocks as I already hold long in my portfolio, I’d typically take the loss in this situation, especially at the end of the year where I’ve taken a lot of realized gains. In DSX’s case, I see a chart that is telling me to give it a little longer before jumping ship. I have the cash available, so I just have to decide which direction I think DSX is going.

The trend lines push me in the hold camp deeper than any other indicator here. This trend of higher lows has been building since the end of March. I suspect it has some more staying power. I don’t like that the 10 day and 20 day moving averages just had a bearish cross over with the 10 day falling below the 20 day. Along with the trend line I just mentioned, what I do like is the volume has been below average for the past month during this decline in price. Add in the Williams %R that doesn’t have a history of staying in the oversold range for long periods and I think DSX will at least make another visit above 30 in the near future.

When DSX does recover I’ll have to decide if I want to sell covered calls on it (the premiums are very high due to the high implied volatility on this stock) or if I want to take my profits and run. I’m still not sure what I’ll do, but whatever it is, I’m sure I won’t wait deep into next week before making a decision. Worst case is that I sell a hefty premium for February expiration and have to hold a stock that has a forward annual dividend yield of 8% for a while.

EDIT: By the end of the day DSX bounced up and I closed my position and wrote a new post on it.