I’ve talked a lot lately about my bad trades, but I am taking a moment to reflect on the good which is most of what I’ve had the past few weeks. It’s just that one bad trade can beat out a few good trades. It continues to be a numbers game with my trading model. I have to make sure I maintain my search for good trades to have premiums that help balance out my losses on positions like NVDA.

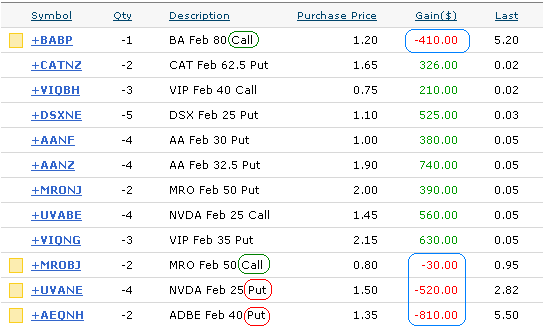

I had the following options expire as of close yesterday. The yellowish squares on the right show which options expired in-the-money (ITM). Two were covered calls circled in green showing that I’ll be receiving cash from the sale of my shares being called away. The two circled in red show that I had too high of a strike and will have to pay when the shares are assigned Monday morning. The blue circles show what I would have had to pay above and beyond what I received if I wanted to get out of these positions before expiration.

I get to keep all the premiums since I didn’t buy back any of the options above. All those gains go to cover stocks like MRO and my loss of $2500 that I will realize once the shares are called away. I’ve written options on MRO for months and now have to pay the price for the fallen stock. BA will be called away on Monday too. That’ll be a loss of $2000. All the sudden my $5000+ realized gains above will only be used to balance out my mistakes and not fatten my account value.

That’s actually why I like options. I can have such bad trades like MRO and BA and I’m still coming out slightly ahead. Gems like VIP were great moves for me. I sold three Feb 35 puts and three Feb 40 calls and VIP closed right in the middle at $36.78 allowing me to “win” on both and keep the $800+ in premiums as realized gains. (That’s called a “short strangle” for those who like using cool options terminology.) I’d like to start using more of these when the opportunity presents itself. I was guaranteed to win on one of them and was able to swing a win on both.

I’m extremely happy this expiration has passed as I can better regroup now with few stocks in play and really try to make up for the losses coming from a few more of my losing trades. Identifying and accepting the balancing act of big option premium gains vs equal stock losses can play a major roll in keeping emotions out of investing. I could be sad that I have a loss of $1500 coming on DWA or could be smart and go make five more $300 smart trades to make up for it.

When I make fewer mistakes (due to better planning or even luck) those losses don’t hit my account and I only take in the premiums and don’t look back. For the foreseeable future, the game for me is staying a little better than even in the hopes that when the bull returns I can go back to bigger gains. Flat in the bad years and 20-30% gains in the good years can come out to a great return over time. That’s my true focus still, big longer term gains earned through shorter term trades.

One of the other benefits of options is that even when you get assigned stock at a loss, you get the stock at a great price. Sometimes it might even be good to move stock to a long term account.

How did you setup Ameritrade to show only the February options?

I created a customized view that I use all the time and sorted by time value. I just cut off the March options in my picture.

I never realized there was a purchase price column or that you can sort by time value. Thanks, my life just got that much easier.