Kadena is probably one of the readers who has been around My Trader’s Journal longest. He’s in the US military stationed in Asia and trades while he could be sleeping. He comments often and we exchange emails more often. I received this from him last week and he said I could share his results from day trading. I thought this was very interesting considering where he was just a few months ago. In September I posted this story from Kadena, that shows how he lost $30,000 in three months. That was 75% of his portfolio. He lost more after that before figuring out a day trading system that seems to be working better for him.

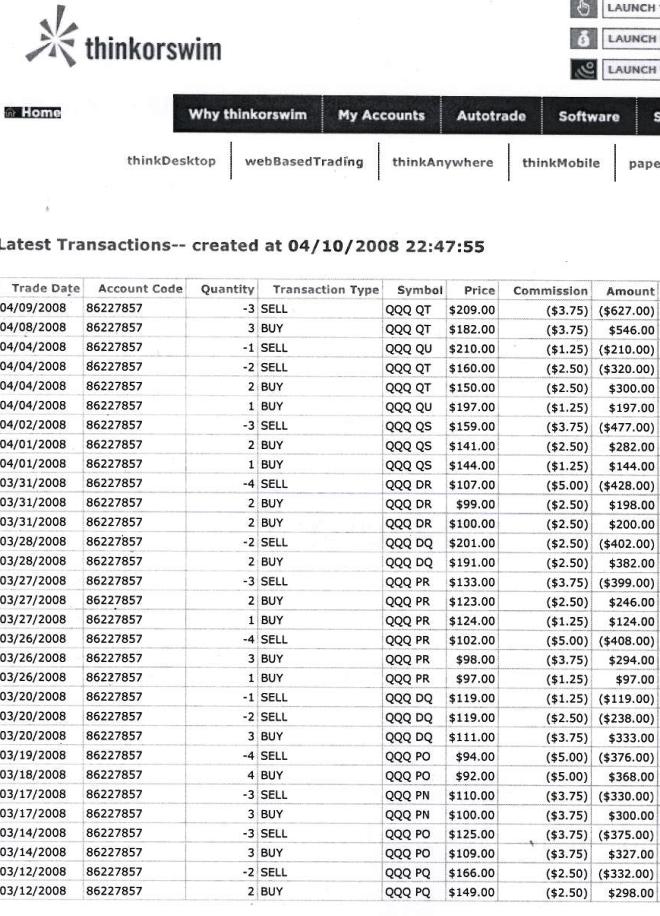

He sent me the following screen shot of his trades. You can see he’s starting small and staying small to get big. His strategy is to make small gains every day. He had a long streak that just ended with some small losses, but he doubled his account value in a month buy taking small bites. His plan is to day trade and exit positions before market’s close. He hasn’t stuck to that on each day, but bases his strategy around this.

I find it interesting to read other’s trading plans and details. I’m assuming you do which is why you read my trade details, so enjoy another trader’s approach to working this market.

This is most of an email he sent me that shows a new lesson he learned while developing this day trading strategy.

Alex,

Here’s a take what happens when you are on the wrong side of QQQQ options. A single call opened Friday (April expiry) is down 50%. Some May calls are down 25% and some June calls are down less than 20%. Opening calls Friday was a mistake, it wasn’t conducive at all to day trade Friday, and holding isn’t part of the plan. So things go wrong, but after Monday’s tiny move, I’m egged into holding longer to see if we follow our typical pattern of getting back what was lost. I’ll be more upset with myself the longer they are unresolved, primarily because both Friday and Monday were excellent trading opportunities, if done right. Which is why I may cut losses and re-assert myself to my day trade plans. Mixing longer term projections causes this. So, the main point is how easy it is to get off course from a simple day trade. Glad I showed you the other trades, because you’ve seen I know how to do them, and anyone can really. But, anyone can get bungled too!This is good knowledge to see, as I knew my consistency would be tested, but let’s just see what happens, it won’t be the end of the world.Also, the last time I entered in overnight I think I planned to enter differently, but in excitement Friday didn’t follow my plan.

All a trader needs is discipline. I won’t see my thousands of dollars until I iron this out. This will only prove to be short term, minor setback. If you lose 10% you have to make 20% on the new balance to get it all back. So, that helps me know how much I may be willing to ‘lose’ as getting it back just requires time. I understand preservation is key, but I’m going through some trial learning circumstances. And, of course, options are powerful enough to re-cover. And I have proven I can do it right. So, in the end like any program, all of the rights must be more than the wrongs, and the winners must outweigh the losers over the long haul.

The email above was from last week and he sent me this email Wednesday night to show he made everything back form recent loss he took.

Alex,

Of course, Wednesday helped my call QQQQ positions. What it boils down to is the positions I took Friday, when market was down 265, all recovered prices by today. So my balances are intact. Suffered commission losses for 3 contracts in Etrade only. But I closed at like 12:30 EST (my time 1:30 AM) so I could go to bed, and missed a little upside. However, with IBM, the after hours continued bullish. But that’s beside the point, the considerable ‘losses’ all re-covered and I was thrilled. And when I say considerable, I mean percentages that I mentioned the other day. Meaning what it all amounts to now is opportunity lost Friday, Monday, Tuesday and Wednesday. Since I wasn’t trading, but holding the calls.Friday needed to be puts, and of course today calls worked.

My newest position from Thursday will be reviewed later; but I had an idea about options that may help me to learn exactly how the trading days, and market prices affect them. What if someone bought puts and calls of equal investment (like 2, .50 calls and 1, 1.00 put) in tiny sums each day for the first 2 weeks of the month, or maybe even the whole month. Your goal would be to sell, or close each day pair at the right time. If you are familiar with spreads on options, you must ‘know’ what you want the market to do entering your verticals, diagonals, etc. I feel like it’s tough for me to know all the price movements to expect without some crazy trial like this one mentioned. At 50 to 100 bucks a day, it wouldn’t cost much, and losses if any should be limited. I may only be able to trial for one week first, buying mon, tues, wed, thurs, fri, tracking action on both sides (calls, puts) and closing when beneficial if possible. Time factors and other Greeks are what I’d like to learn out of all this. Thanks for any thoughts. Good luck to everyone.

Kadena

PS Thanks to Alex for sharing some of my investment history with his readers, and being there when I need fellow ear to holler at… (Also, i have 2 broker accounts, so wouldn’t run into problems owning on both sides ever, just would have to shuffle money.)

Thanks for allowing me to share it. I’m interested to hear if any other readers have some suggetions for you. My experience is quite limited on the index options side.

@Kadena: If you close the ratio spread at the same time (i.e. buy the call and put back together), the strategy you are proposing is essentially long vega and short theta. So you are betting that there will be spike in volatility (i.e. a move either way) before time decay eats you alive. That’s a good bet if VIX is trading low and there is market volatility, like right now with VIX @ 20 and big market swings. This will not work in the opposite case. If there is a quiet period of consolidation with a high VIX, the time decay will eat you up. On the other hand, you leg out of the spread (i.e. close one when it’s in the money) then it’s a different strategy. In that case you have to guess the direction and size of moves… Tough either way.

And this is why I stick with selling theta. It’s just simpler and doesn’t require as much thinking (except for the risk management;-)).