Joy Global (JOYG) gapped down today after beating estimates, but with aid from tax related gains and that didn’t please the masses. Their outlook is still good, but the market didn’t treat it that way. I own 100 shares that I bought much higher after being assigned an earlier naked put at $75.00. I’ve sold covered calls since then and reduced my cost to around $57.50 with today’s trade, but with the gap down today I’m sitting on a paper loss as JOYG closed the day at $53.05.

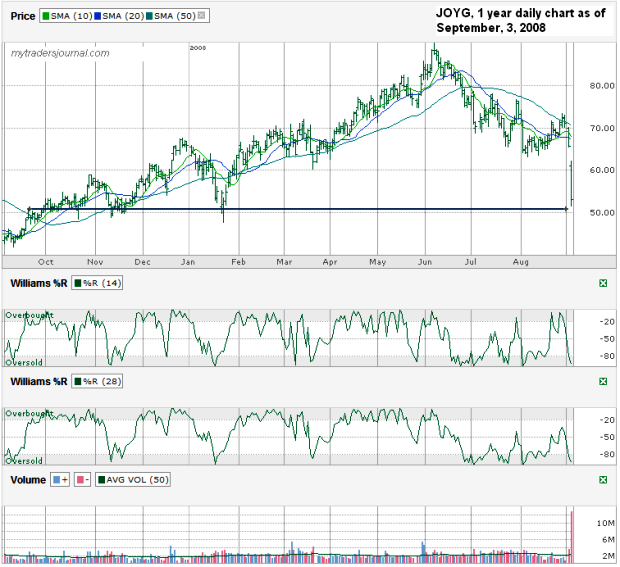

I charted JOYG to see that $50.00 could be an area of support as it was last fall a few times and in January of this year. I entered a limit order for a naked put after lunch and while JOYG was trading at $52.10 I sold one September 50 naked put (JQYUJ) at $1.75 and received $164.25 after commissions. The premium isn’t big, but it’s only with 12 trading days remaining and it’s still out of the money. My order hit $0.05 from the high trade of the day.

JOYG might not have found a bottom yet, but I think it’s within a few dollars of it. If it closes under $50 in two weeks I’ll be assigned another 100 shares and my average cost per share will be cut greatly. I’ll then sell covered calls on all 200 shares and expect to pull a profit out of the series of trades. My trade this afternoon was as much a move to bring in a few more dollars as it was to put me in a good place to dollar cost average my average price down.

JOYG has reacted severely to news in the past and tends to bounce back with a lot of momentum. I’m banking on that happening one more time. After this I might have to ease back on JOYG due to its global exposure. If the world’s economy is slowing, JOYG won’t be the place to be. For now, I’m going with the estimates and the expectations that JOYG’s profits will keep coming.

Minor suggestion…I would be great if you could also include the execution price on your trade related posts.

Good suggestion. I’ve updated it above and will try to remember to add that to my trade details in the future.

If you need to look back at any, at $0.10 to what my after commission take was and you’ll see close to what it was.

It’s not a bad market to be a seller of premiums. I’ve seen huge spreads in many different contracts today.