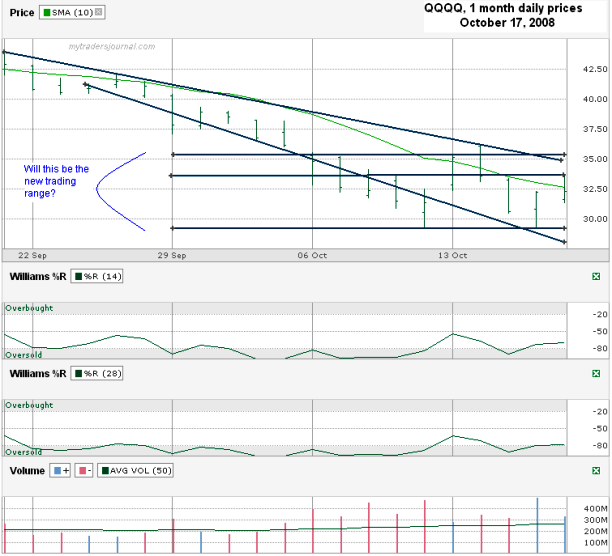

I’m returning to chart the PowerShares QQQ Trust Series 1 (QQQQ) for the first time in a while. I only went back one month with today’s chart because I think I see the best story on such a short time frame. What I see (although it might be too early to be sure) is a potential new trading channel for QQQQ. The current price is creeping back up to the longer term down trend of lower highs which could coincide with the top side of this new trading channel this week.

If these two lines break (33.50 and 35.00), I could see a run back up to the 41.00 range that the QQQQ toyed with a few weeks ago. I’ll be cautious until that happens. In a bullish view, the Williams %R broke above oversold for both the 14 and 28 day indicators. Another up day could make this more convincing. Also bullish, volume was up for the past couple of up days the QQQQ has seen. I’d like to be more bullish, but until the down trend of lower highs breaks, the other indicators won’t do much to sway me.

I plan to sell covered calls on all the stocks assigned to me in October options expiration with the belief that if the market rallies, it won’t be sustained for too long and if I get out too early from some stocks, at least I’ll be out when the markets remember we’re in a recession still. I’m sure panic is pushing some stocks down more than they should be pushed, but I’m not sure the panic is over. We have a lot of bad numbers still due to hit the wires, such as increasing unemployment and the ever struggling housing market.