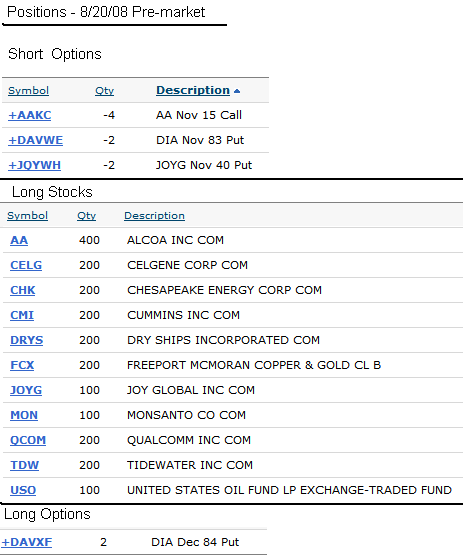

I’m posting a screen shot of my current stock and option holdings before I start selling covered calls this week on my long stock positions. I closed out my last $25,000 remaining NPLXX money market I was using as cash back up and still have $8,993.35 on margin to start the day. I took naked put assignments on a few options and was forced to make the following trades:

- Bought 200 CMI at $40

- Bought 100 FCX at $60

- Bought 100 MON at $100

- Bought 200 CELG at $60

- Bought 100 TDW at $50

With the futures up this morning, I could luck out and find an opportunity to exit a position or two for a profit soon. That’s not likely, so I’ll sell calls to reduce the amount I have on margin and will consider selling a stock for a loss if I think it’s going down. If everything flattens out, I’ll make more from option premiums than I’ll pay in margin interest. The larger risk is that we haven’t bottomed yet and I lose on the stocks I own on margin. The second risk is that we have bottomed and if I sell covered calls too soon I’ll miss out on upside gains. That’s what I’ll be pondering all week as I ease my way in with more options.