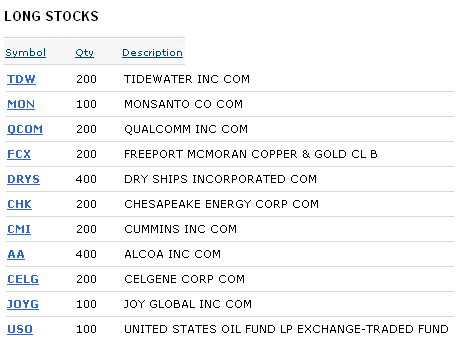

I’m back from vacation and see that we haven’t found the bottom yet. I pasted screen shots of my current portfolio below. I circled the two December options I have in my account. The rest expire next week at November option expiration. I tend to write only about my mistakes lately since that’s what I have the most of.

In my effort to become more delta neutral on my oil play, USO, I added more downside exposure in the form of naked puts only to see oil fall even faster. The December covered calls at the same strike are still rich, so I think I’ll work it out over time and still have seven USO calls set to expire worthless giving me a full profit.

DRYS showed a cute bear market bounce and I fell for it by buying 200 shares to turn my naked calls into covered calls. DRYS has fallen by more than 50% since then and that’s after my earlier mistake of selling 17.50 naked puts a few weeks earlier. Oddly, I still think DRYS will come back up (one day).

On a positive note – I checked my mail at home today and found a gift from Johnnie Walker for me. I’m on their mailing list from a scotch tasting I went to years ago. They sent me a somewhat nice snifter with their insignia and a code to order a matching one from their site, which I did. After losing 9% in my account today the snifter has already been put into use with a nice single malt (not Johnnie Walker).

I’ve been selling short term (1-2 months max) out of the money naked puts, whenever stocks/ETFS in which I’m interested decline significantly. However, I haven’t been taken many positions yet. So far I’ve sold Nov 60 MON, which has been closed, NOV 42 DUG, and NOV 20 ENER. Everytime the financial sector rallies, I consider a selling a put on SKF, but haven’t done so yet.

Seems like it’s been a smart/winning strategy. I did the same on SSO, but got in too high on others.

Hello,

Can you explain how you calculate the delta of of a position and the advantage of it being delta neutral?

Thanks,

Mark

What is your current holding time frame for these long positions and what where your thoughts on yesterday BS bear market rally. Wealthy hedge fund clients are pretty upset because they know these hedge fund guys were tripling down their positions and that was a very desperate move.

I thought yesterday was a bounce off the earlier lows and probably included some automated buying. I’m not too excited about it, but am happy to see that I didn’t have another down day. I was down 9% on Wednesday and up 12+% on Thursday. That’s a year’s worth of change in a day. My holding time frame on these so far varies from one month to more than six months on one or two I think. I used to track that closer, but that was part of my trading journal I cut out when I changed jobs and got busier.

I’ll have to write a longer post on what Delta Neutral is. TD Ameritrade has a tab I can click on that shows my delta breakdown for all my holdings. I don’t have to do the math. Before trading, I can check the options table to see all the “Greeks” to get an idea of how each potential trade will affect me. I tend to stay more Delta positive since I tend to be more bullish most years, but still watch it sometimes, like on USO, when I have so many short options on one side. The advantage for me on USO to be more delta neutral is to try to profit on time value decay on both sides (up and down) while USO trades in a channel and to profit if volatility drops since I’ve sold all of my option legs on it. If I think a position will stay more flat or stuck in a trading channel I’ll pay attention to delta. It keeps me from being too overweight in one direction and gives me potential for a profit if my expected direction is wrong. I should have stayed more delta negative on USO since my original thesis on oil stayed true and USO sank. On USO I saw I was very delta negative which meant I lost every time USO inched up. By selling new naked puts I became more delta neutral which gave me gains on the puts as USO climbed and that balanced me more. If USO closes next Friday between 51 and 60 I “win” on all trades.