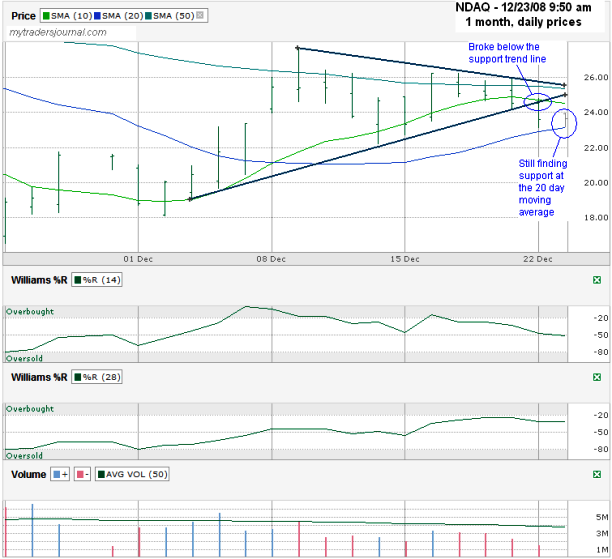

Barron’s highlighted NASDAQ OMX Group Inc (NDAQ) a couple of weeks ago as a stock to watch and I’ve been watching, but can’t see the right time to get in yet. I’ve charted it every day for the past week and have waited to see in which direction the triangle would break. Luckily I didn’t get in yet since NDAQ broke lower. I’m still watching it though. The chart from yesterday and today (the chart below is from around 9:50 am) show NDAQ is still finding support along the 20 day moving average. If that line can hold, NDAQ can have a fighting chance to return to its climb upward that started in November.

I’m not too concerned that NDAQ won’t be a good long term hold, but I’m considering selling naked puts on it and want it to at least stay flat for the next month. Until I see longer support on the 20 day sma, I’m going to be careful about putting my money at risk. I have a trade alert set to text me if it gets back above $26.50. I hate to miss the run back up there from its current price under $24.00, but this market is still not the place to take lots of risks. If we were in the middle of a bull market I’d be happy with this risk, but we’re not.

It’s smart to protect yourself, just remember that it is possible that the bear market will last for years. Take a look at Nasdaq and SP500 futures markets, great way to make money from the short side.

Ruben, I’m with you that I don’t think we’ll be back to the good old days for a long time to come. If we can move sideways, selling options is a great strategy. It’s those big moves in either direction that cost us when we sell options.

I very liked this post. Can I copy it to my site?

Thanks in advance.

Sincerely, Timur.