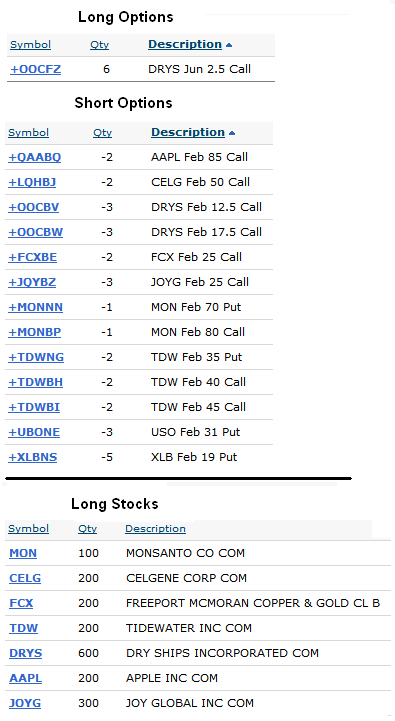

I’ve been itching to make a new trade today, but held back since it seemed I didn’t have any good ideas other than it’d be cool to make more money. I tend to make mistakes when that’s my starting point. Instead of posting trade details today I’m just showing what my current portfolio looks like. I own one call, I’m short a handful of calls and puts and I’m long a smaller handful of stocks.

While I write this at 1:05 pm my account balance is $56,493.54, still ahead of my goal for January (but the month isn’t over yet). I mistyped before January options’ expiration when I said I wouldn’t be on margin since I freed up some cash to cover my AAPL naked put assignment. The slip was due to the fact that I had two AAPL naked puts and that option assignment put me on margin. With the options I’ve sold over the past week and a half I’ve brought my margin balance down to $7,690.46. I’m comfortable letting that sit there since I think I’ll make more using that money in play than the margin interest will cost me.

Since you have zero financial exposure here’s an idea: Sell February 4.00 Puts on UYG ($3.69) for $0.65. If assigned then sell March 3.00 or 4.00 Covered Calls on them. I sold 20 Puts at $0.80 two weeks ago and will be happy if assigned. Cheers!

I’ve been avoiding the financials for a while, but I probably should have a little exposure. I’ll have to think about that trade. It makes sense, but anything tied to banking/finance scares me still.