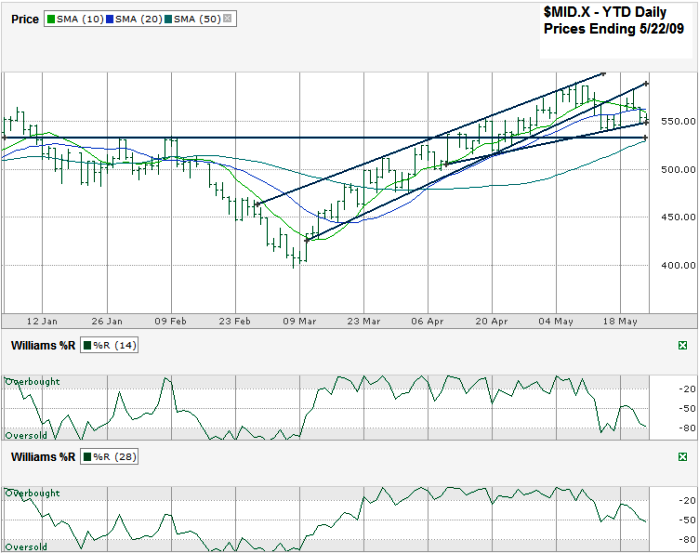

I charted S&P MidCap 400 Index ($MID.X) after it closed on Friday, May 22, 2009 at 551.28. Almost two weeks ago the MID broke below the supporting trend line of higher lows that it has been following since its lows in early March. That timing came with the break below overbought for the Williams %R. Breaking the Williams %R indicator along with a 2 month trend line break typically signals the beginning of worthy downturn. The MID fell a little more than 8% from its intraday high on May 7th (589.88) to its intraday low on May 14th (540.86) and then found support again. It has edged up since May 14th along a new trend line and still sits up more than 38% from its March low.

The gain has moved quickly and sharply upward, but the attempt at a real correction was weak. If the midcap index doesn’t fall further to truly correct, at best we will watch a prolonged consolidation where prices will move more sideways as we wait for the hopes of an improving economy become a reality. Other hints that the upward move could face resistance are found in the 10 and 20 day simple moving averages (sma). We saw a bearish crossover of the 10 day sma moving below the 20 day sma on Thursday. Friday confirmed that move with the MID hitting resistance at the 10 day sma, but holding support on the shortest trend line I drew.

I expect the short trend line of higher lows to break support soon while the moving averages show their strength. An area of support is nearby though. 530/531 acted as resistance four times in late January and early February. April saw another few days with intraday highs and lows coming within an arm’s length of that same line. If the midcap index falls early in the week that same horizontal line will match up with the 50 day sma and both together could offer decent support. And there’s more – a full 10% correction from the May 7th high would bring the MID down to 530.89. As with all technical analysis, that could be a coincidence, but I’ll be watching with great curiosity.

I have also been watching this level, we need a bounce right here if this short uptrend we have been in lately is going to continue. We will see what it does.