For the third day in a row I sold a Monsanto (MON) option. Today it was to close the only long put I had. While MON was trading at $78.62 my limit order hit and I sold to close one MON June 80 long put (MONRP) at $3.60 and received $349.25 after commissions. That gave me a realized profit on this single leg of $80.51. My total cost if my short June 85 MON naked put is assigned will be $79.00. If my second naked put, June 75, is assigned my average cost will be $77.00. My break even point to the upside is now raised up to $91.00.

I feel pretty good about owning MON with a $77.00 cost and will manage the shares with covered calls from there. I based my decision to remove the hedge on two factors. 1. I think MON is a good longer term play and the reduction in earnings was only based on its herbicide division. 2. I picked the exit price for the option based on the chart and the trend line of slightly higher lows recently. I don’t expect MON to go to much lower before gaining more solid footing. If it does, I expect the buyers to show up before my options are assigned. I didn’t hit this option’s high of the day with my order, but think I did OK with this exit price since I’m now sitting at break even on paper.

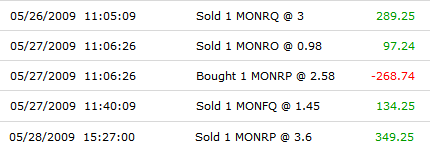

Here is a screenshot of the trades on MON I’ve made over the past few days:

Today i spotted Alex goal for Series 65 and etc. As one of his earliest readers, he knows i support any decision he makes. My experience in options hurt me to the tune of $50,000. Whether you manage money yourself or ‘trust’ someone else, it should take your full attention. I work in the AF and have a family, and was too disorganized to be successful on my own. Now, I’m looking for CD’s or zero coupons until i can find someone else to help in search of higher return. Now where’s the nearest gas station selling lotto tickets?

Kadena, Good to see you are still reading when you have time. I hope you and your family are doing well. Hope you make it back to the States soon.