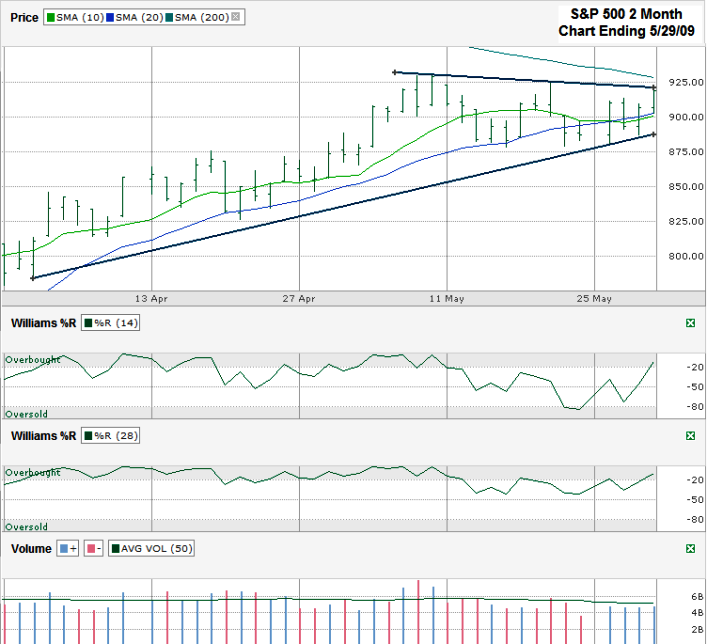

This weekend I’m back to charting the S&P 500 Index ($SPX.X). It’s about to get really interesting with a couple of different technical indicators converging soon.

Bear Case

The SPX closed at 919.14 on Friday, about five points below its 200 day simple moving average. Also it hit resistance at the short trend line of lower highs that started back when I posted my last S&P 500 chart in the first half of May. Both of those lines together are going to make it hard for the SPX to get above its current price. The May 8th intraday high of 930 will be another key point of resistance to the upside, but getting to that is going to be hard based on how resistance was met again on Friday at the trend line I drew. The 10 day moving average fell below the 20 day moving average. That’s worth mentioning for its overall bearish signal.

Bull Case

The SPX found support at its 20 day moving average, very close to its 10 day moving average. Both lines broke over the past few days, but the move back above them is more bullish now. The biggest bullish indicator going for the SPX is its long trend line of higher lows. It acted as support twice this week. That’s going to be an interesting line to watch, especially as it nears the trend line I mentioned above of lower highs. One of those lines has to give.

Conclusion

I’m still expecting the bears to win a battle soon and have the SPX drop further before turning into a lasting bull market. Either way, these next few weeks, after the “sell-in-May” time will be interesting. Once we do get a decent 10% pull back, whether it be in June, July or later, that will be the time to get invested fully and quickly. So much money is on the sideline waiting for a pull back that once we get it and investors/traders think that’s a good entry point, the rest of the money will follow quickly.

We’re in a nice low-volume sucker’s rally. The markets are being propped up with contrived optimism and inexhaustible TARP money in an attempt to lure sheeple back in. It will probably work. But, more foreclosures and job losses are coming so keep on hedging. All IHMO, of course. Good luck.

Mule, your humble opinion is quite worthwhile around here. You’ve helped me a lot and luckily I already agree with you on this one.