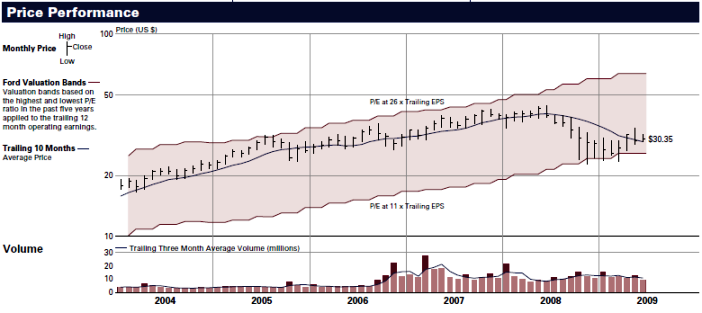

Kopin Tan wrote a bullish few paragraphs in today’s edition of Barron’s about CVS Caremark Corp (NYSE: CVS). One of his points for calling CVS a buy is the historically low P/E ratio it has right now. I checked Ford Equity Research and found this chart of CVS’ historical P/E versus it’s current price to earnings ratio.

I’ve had some good luck with charts that show P/E’s in the low historical ranges and decided to check the chart of CVS for its trend lines. The chart showed potential support coming soon, either close to the current trading price from early in today’s trading near $29.80 or next at $29.00.

I started my order as a naked put with a $30 strike, but decided I should aim lower to give myself a better probability of the option finishing out of the money. Before putting in an order for the $29 strike I double checked myself to see how I could hedge it. I noticed the $30/28 vertical put spreads offered the same premium as the naked $30 strike puts. I decided hedging my trade made more sense in this market than taking the full downside risk since the upside was the same. The difference is that I took away $1.00 from my cushion of the options finishing out of the money. If it expired this week I wouldn’t have taken the chance, but I think that even if CVS dips, it shouldn’t be for long and I’ll ride out my position.

While trading at $29.81 my order hit. I sold to open five CVS July 30 puts (CVSSF) at $1.25 and received $611.24 after commissions and bought to open 5 CVS July 28 puts (CVSSO) at $0.50 and paid $253.75 with commissions as a hedge. My limit order was for a $0.75 credit. I came away with a net credit of $357.49 after commissions.