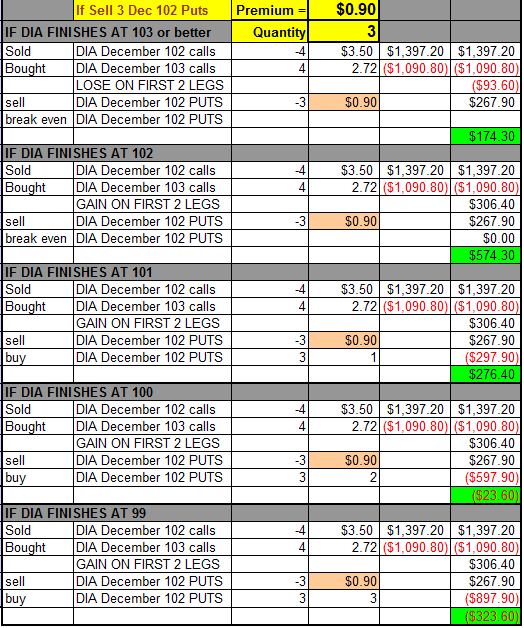

After I sold the DIA bear call spread on Tuesday I quickly started to lose my patience, but didn’t panic. I kept charting (throughout the day, all day) and although DIA (and the Dow) kept inching its way to new highs it fell quickly soon after each time. As I pointed out in the post I referenced above, I had a low probability trade for a low dollar risk. With DIA not falling on queue like I wanted it too I started thinking of ways to give me a profit if DIA went up or down. I started piecing together this Excel spreadsheet below and by the end of the day yesterday I had four strikes etched out to show how I’d fair depending on where DIA finished at December expiry. With DIA bouncing around so much and the premiums changing quickly, I made the premium cell at the top automatically flood into the appropriate cells below. I did the same thing for the quantity of puts I could sell.

What emerged was a much clearer picture of my options (no pun intended). My plans by the end yesterday through this morning changed about five times as DIA jumped at the open, only to falter again (this time on queue at that slightly improving trend line of higher highs). I waited until I saw what looked like it was low enough to make the premiums worth getting in, even if DIA went lower by a few bucks. Based on my spreadsheet, the 105 strike would have giving me a loss at the most points of reference, so I eliminated it as a choice even though the upside was greatest if DIA breaks out to the upside. The 104 strikes could have worked, but made the downside risk bigger than I wanted to accept. That put the choice between the 102 and 103 strike puts. The 103 strikes would give me more profit if DIA stays above $103, but using the 102 strikes gave me a better downside cushion and $200 more potential profit if DIA closes at my target price of $102. So, with a lot of playing around within Excel, I came up with a clear choice for the $102 strike. I toyed with either two or three contracts and decided three was worth the risk. It also leaves me with a possibility of adding another contract at a higher strike if DIA finally breaks out above the 105/106 level with better conviction.

While DIA was trading at $103.45 I sold three DIA December 102 naked puts (DIAXX) at $0.90 and received $267.90 after commissions. I still see support likely around $102, but if that fails think $100 could be the next decent level. I’ll be close to break even if that happens, but will probably exit the full position if DIA heads south of $102. With only two weeks to go until expiration, the time value will drop on these quickly if DIA remains flat or heads higher. At $100, that’d be about a 5% drop from its high which has been close to the support level on dips for months. Eventually that won’t work, but I’m so underinvested elsewhere that I’m not risking much for a full portfolio.

(Ignore the green colors in the cells, it doesn’t mean profit. It’s just the color I chose to make it stand out when I was looking quickly. I wasn’t careful with my wording because I wasn’t planning to post this, but then thought some of you would find it interesting. That lack of planning left a few other unclear points – “break even” should be “expires worthless”, the third cell over from “buy” is how much of a loss I’d take on the put if I had to buy it back. I’m sure there are other mistakes, so ask if something isn’t clear or you see a mistake.)