I misjudged UCO’s potential decline by $0.35. That’s how much of a loss I would have taken on my UCO December 12 naked puts if I had bought them back today. Instead, I let the options expire in the money which means I’ll be buying 500 shares of UCO on Monday at $12.00 while it finished today at $11.15. I considered rolling the expiring puts to January for a net credit as Mule65 suggested in my post’s comments yesterday, but at the time I placed the order I had a slight advantage by selling calls instead.

I don’t mind taking ownership of the 500 shares and also added a new naked puts to buy more if UCO drops more than 10% deeper. I can turn this into a long term play on oil because I don’t think UCO is going lower than $9.00 and more likely will move up from here based on the chart and how I think demand will probably play out. The main risk is the dollar improving too fast.

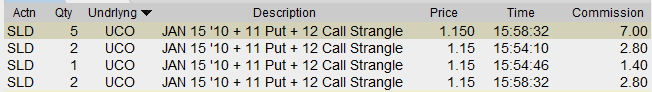

While UCO was trading at $11.13 I sold an option strangle at $1.15 and received $568.00 after commissions. The two legs were five UCO January 11 naked puts (UCOMJ) at $0.70 and five January 12 covered calls (UCOAE) at $0.45. I tried my order at $1.20 for almost 10 minutes, but since I really wanted it to hit before the weekend I lowered it $0.05 and it trickled in. I included a screenshot below to show how my limit order hit over nearly four and half minutes at the very end of the day. I think that shows that I priced it as good as I could without risking missing the order. I wanted the order in before the weekend to try to squeeze a little more time value out of it rather than dealing with it on Monday when I need to be searching for new options to sell.

I debated which strikes to go after, but since I believe UCO has limited downside, I went with the higher strikes. This gives me another $425 I can gain by the potential $0.85 gain in price from UCO up to the $12 strike from its current $11.15 level. If UCO stays below $12.00, but above $11.00, my cost per share for 500 shares will be $10.37. If UCO is below $11 at expiration, my cost will be $10.19 per share for 1,000 shares. If I’m way off the mark and UCO goes as low as $9.00 in the next month I expect to be able to sell $10 strike covered calls for $0.45-0.50 each which would be approximately a premium I could take in of around 5% each month until oil comes back up.