I’ve been collecting a list of dividend paying stocks and ETFs for the past few months as I broaden my scope not only for my clients, but for my own personal investing too. I’ve mentioned my draw towards dividend investing a couple of times over the past months and thought by posting my dividend stocks list some of you could help me add some that I might be missing that are worth a look.

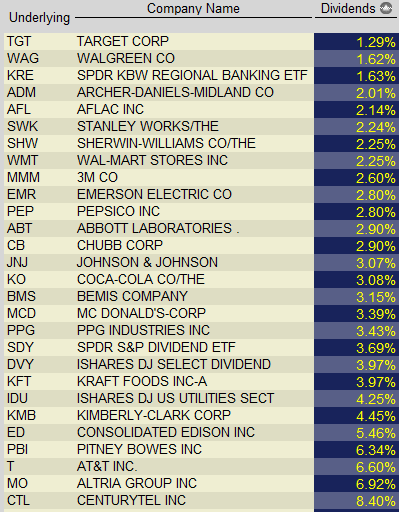

Most of the stocks on this list came from articles I’ve read on other sites and Barron’s newspaper. This screen shot is from my IB account and actually came from last week when I first started putting this post together and then I got distracted with making some trades.

The obvious benefit from selling options on dividend paying stocks is that you get an extra payment built in to your planned gains when you are long the stock. You don’t get that benefit when your only exposure is through naked puts. Dividend stocks can give a little more support in a down market if it is believed the dividends will remain untouched or continue to grow. I don’t pay as much attention to the ex-dividend date when selling options as some traders do. I figure if I’m looking out more than a few months worth of holding one of these stocks then the dividend will roll around for me again soon enough. If I’ve identified a good entry point then I’m comfortable with the trade without the dividend. If I’m assigned the stock then I consider the dividend a bonus on top of my option premiums.

AFL and KFT are the only stocks on this list I have options on right now and both are scheduled to finish out of the money in three days. I’ll be adding new ones. Let me know of some I’m missing. I recognize I am missing some gems since this is such a young list. I’ll collect all that you give me and will continue to add new ones through my own research and update this list with a new post every so often. Thanks for your input.

MET (metlife) pays good dividend.

Thanks Renee! A 1.80% forward annual dividend yield is definately worth adding to my list.

BX is one that was put to me a year ago at $10, i have continually held it and collected the div which is every quarter. Has been one of the best performers in my portfolio. Dividend & Yield 1.20 (8.32%)

Rgds

Mark

Here's a few that I follow that still appear to be reasonably valued:

Bristol Myers Squibb (BMY) – Pharmaceuticals

Buckle (BKE) – Specialty retailer (clothing)

Cintas (CTAS) – Uniform supplier

Diebold (DBD) – Security systems and ATMs

Exelon (EXC) – Electric utility

IBM (IBM) – Computer services provider

Mine Safety Appliances (MSA) – Protective equipment manufacturer

Owens & Minor (OMI) – Medical and surgical supplies distributor

Pfizer (PFE) – Pharmaceuticals

Many of these companies have a good history of paying and growing their dividends. I'm currently short puts on all of them except OMI and – as of today when my short puts on it expired OTM – BMY.

Altria Group is a very nice stock to add on your portfolio. It’s the best performing dividend stock. I’m looking forward to buy AT&T soon. By the way very nice list.