I have AVAV covered calls expiring tomorrow and it looks like I’ll be holding onto my shares, i.e. the options are out of the money by more than 6% with one day to go. I’ve been debating what I should do; exit my position now or hold on for one more round of covered calls. If I do write covered calls again, should I sell at the $22.50 or $25.00 strike? I looked at AVAV’s daily prices for the past six months and see some declining trend lines and a couple of horizontal lines that should act as resistance. The one trend line of higher lows isn’t too far away from AVAV’s current price and could be the line of support AVAV needs to get it moving higher again.

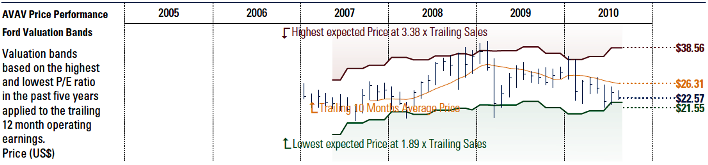

After checking the chart I also looked at Ford Equity Research’s Valuation Bands to see how AVAV was looking from a value perspective. The Ford information is from August 13th and already since then AVAV has gained almost a dollar. The big take away from the second chart is that AVAV is at the bottom of its valuation band. Couple that with the fact that AVAV has a forward P/E lower than its trailing P/E and it looks inviting to just stay long.

My average cost per share is down to $22.17 including all of the premiums I’ve taken in so far. If I want to increase my chances for a profit and exit I should sell $22.50 covered calls, but if I want to go for a much bigger gain I should aim for the $25.00 strike covered calls. I’d like to go with the October expiration calls, but they aren’t posted yet, so I can’t get a jump on the game. The premiums for the September calls make the $25 strike options not worth the trade, but the $22.50 aren’t so bad. I’d take a $2.50 loss on the shares, but my average cost would come down low enough to let me exit with about a $2.00 profit per share.

I started with AVAV four months ago with naked puts. If I sell my shares in October (that’d be six months total) from $22.50 covered calls I will have made better than a 9% gain in 6 months (aka 18% annualized). That’s hard to resist pocketing that gain on a stock that I made a mistake on based on it being lower priced now than when I started with it. If AVAV continues to slide then I will have made the right move by lowering my cost per share even further. Now that I’ve written all of this I seem to have made up my mind. I just need to wait for the October option contracts to post.

—————— —————— ——————