I mentioned in my end of the month summary this week that I sent in another $2,000 to my TD Ameritrade account where I hold my long bond positions. Although I sent the funds in nearly a month ago I just had it sitting there in cash. I was waiting on a dip in bonds and on August 16th I placed a limit order for BND near the bottom of its trading channel.

Finally, this morning BND fell to start the day (now actually below its trading channel and very close to touching its 50 day moving average) and I bought 25 shares of BND at $81.97 and paid $2,058.24 with commissions. Even though I missed the dividend earlier this week I still did better by waiting for BND to pull back some from its run up seen since I entered my limit order. This was a small buy, but I’m not trying to get rich off of this side of my investments. This is supposed to be the more stable side. The bond bubble could bust and I wouldn’t be hurt too much from such a small position, but it still moves me into a slightly better diversified allocation.

My next few deposits might be geared back to my Interactive Brokers (equities portion) account and then I’ll drop some more towards TD Ameritrade again later. I’m slowly working my way up to a 15% position in bonds. I’m up to 12% so far. Once I get to 15% I might I plan to let that sit for a little while and then might start inching my way towards 20%. Depending on how much my account is worth at that time I might be content to leave it at a 20% allocation for a while.

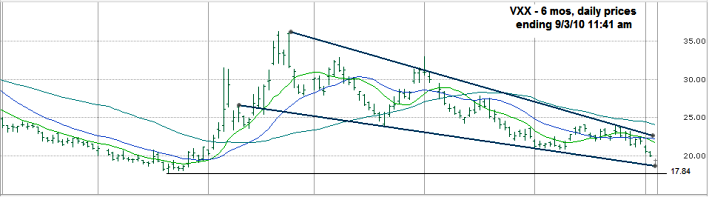

I was very tempted to sell new naked puts on VXX this morning too as it fell below $20.00. It’s touching the bottom of its trend line of lower lows and was within $1.50 of its low from the first half of this year where I expect support again. I decided against adding any more yet since I’m already so heavily invested in the single position and although the premiums are so inviting, the chance of a further decline from here isn’t worth the added risk if volatility continues to fall. At some point I’ll add more, but maybe not until I sell covered calls on the shares I appear to be destined to buy at the next options expiration.

Hi,

I just found your blog, and enjoyed what you wrote. Thank you so much for sharing. I started investing when the market started to fall in 2001. So I lost it all. Then again I started in 2008 before the market sold off. Bad timing. I tried currency market 2 years ago, and this year I finally traded a few options (read and contemplated doing it for a almost a decade). Of all I prefer selling OTM puts with 2-4 weeks on market leaders.Collect some crumbs and be happy.

Hannah, I’m glad you found my blog and that you’ve found an investing style that works for you. I’m the same way as you, take small bites and be happy staying well fed without trying to feast at every chance.