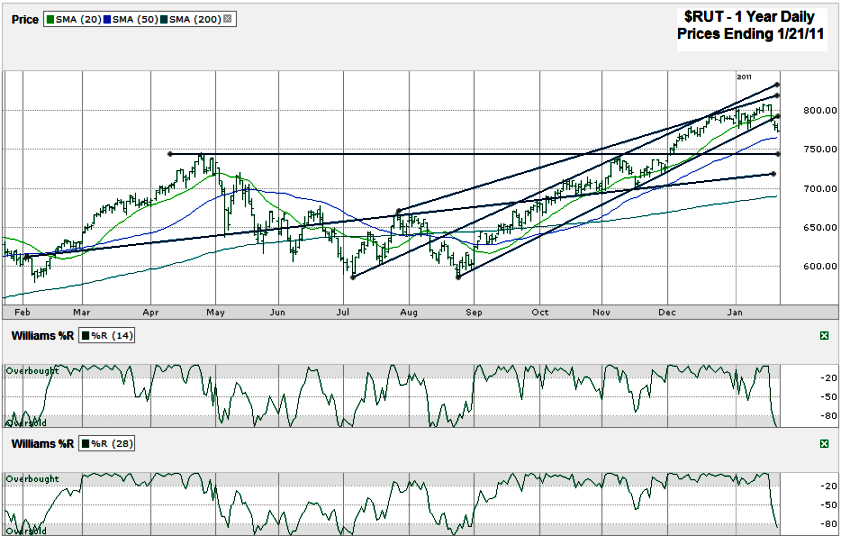

I charted the Russell 2000 ($RUT) after it closed on Friday, January 21, 2011 at 773.18. The small cap index has been on an outstanding run since the end of the summer last year, but this past week issued a stern reminder that it’s not going to last forever. With a 4.26% decline over the past five days, the Russell 2000 broke below its five month trend line of higher lows. This breakdown makes a technical analyst really question if this is the beginning of much worse days to come.

This fall caused $RUT to slice through its 10 and 20 day moving averages to put it just a handful of points above its 50 day moving average. This line (drawn in blue below) will be the first test for the falling knife after ending such a long streak. If this technical indicator does nothing to slow the decline, the next hurdle will be just under 750 which was resistance in November after being the index’s high in April for 2010. I drew another year long trend line that comes in around 725 or so, but I’m not terribly convinced it’s going to have much breaking power for RUT’s decline.

A more likely area of strong support should come from the 200 day moving average. For one, it’s the 200 day moving average and that alone can provide support. Secondly and also very important, a correction that lasts down this far would provide a dip of approximately 10% from Friday’s close and almost 15% from the recent highs. That’s the type of correction that can bring buyers off the sidelines because they might suspect the risk/reward percentages have skewed in their favor.

I’d be surprised to see the Russell 2000 fall all of the way back down to its 2010 lows, but going half of the way there is completely possible. By the way, the half-way mark is right around the 200 day moving average I just mentioned above, around the 700+- range. The Williams %R indicator certainly agrees with the notion that this is just the beginning of a fall that could cause a healthy shakeout of some overly bullish investors and traders. Once we get that shakeout, it’ll be time to get really aggressive again, but there’s no need to do so before we see small cap stocks drop some more first.

I’ve just read your article with interest because I’m conisdering venturing into the world of weekly options via Credit Spreads in either IWM or SPY.

Obviously, I’ll see what they open at tomorrow before I make a move. Hopefully, given IWM’s recent decline, the spreads will offer sufficient credit to make it worth my while.

Ronan, you must have a lot of time on your hands to be heading into weekly options. That can be a lot to juggle.