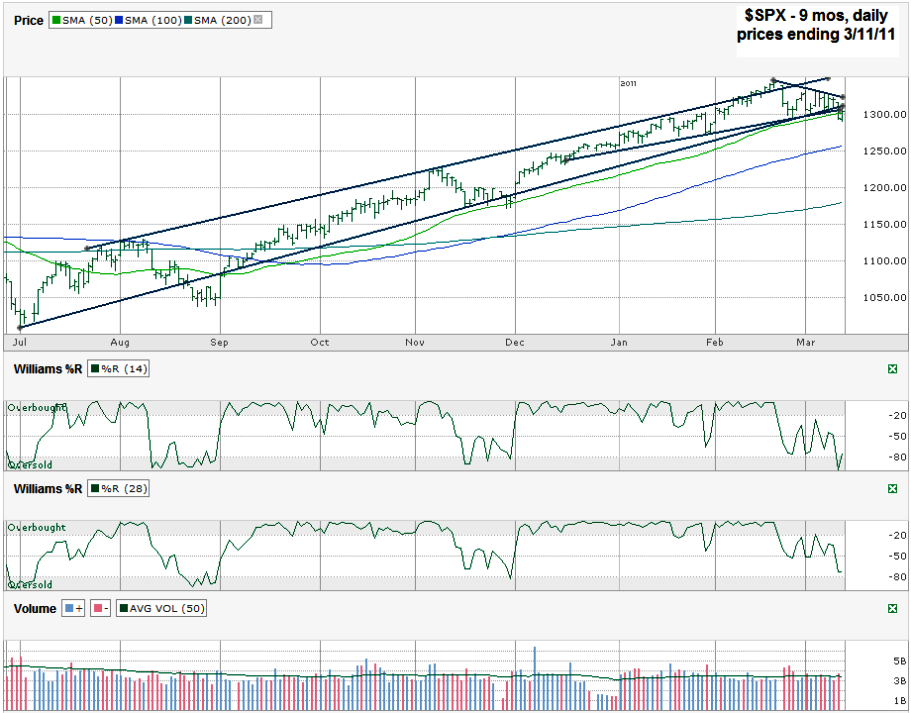

I charted the S&P 500 ($SPX) after it closed for the week on Friday, March 11, 2011 at 1,304.28.

The SPX wasn’t messing around this past week. My prediction of more down days to come after the 10/20 day moving averages (dma) crossed came true. The bearish crossover cleared the path for the index to slice through two trend lines late in the week followed by a break below the 50 day moving average and the 1,294 line that has held a four times this year.

The tricky part about the break in the 50 dma is that it hasn’t had a full day below it yet. Thursday started above it and ended below it, finishing near its lows of the day. Friday started below it and closed above it. These back to back intraday breaks are at a minimum a good warning of more tough days ahead. You can’t quite see it on this longer chart, but the shortest trend line of higher lows I drew became resistance on Friday after breaking on Thursday. This line will be interesting to watch. Watch for continued resistance around 1,310 on Monday to see if it amounts to anything more than a fluke. Couple this trend line and the 50 day moving average which isn’t far below it and we should know the direction of the markets before they actually get there.

The 100 dma is just above 1,250 and might provide a little speed bump if the S&P 500 makes it that low. The 200 dma is around 1,178 – 1,180. I can’t imagine it giving in quite yet. For now it’s close to 12% lower than the intraday high set on February 18th. A 9-10% drop should be enough to get the bull standing and running again, if we even go that low.

Williams %R finally threw in the white towel after stumbling for a couple of weeks. The 14 day indicator moved to its lowest possible levels, but bounced on Friday to get to the edge of the oversold range. The 28 day indicator still hasn’t reached oversold yet. I’m still expecting it to. For it to do so, the 14 day will have to drop back again. That all leads to the chances of more days with lower prices coming to us soon. Friday’s intraday low wasn’t quite 4% below the intraday high I mentioned earlier. I don’t consider that much of a correction yet after such a long, untested run. The way this bull market has been, 4% could be enough to refuel the buyers and get us moving higher. I’m not too anxious to prove that theory yet, but will be ready to jump aboard once the 50 dma is out of play again.