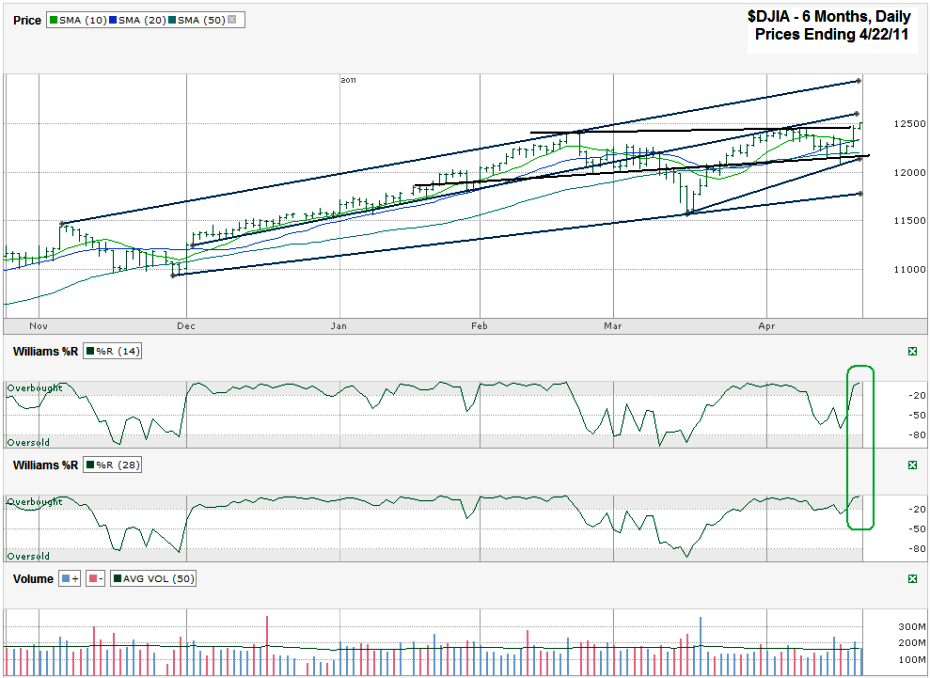

I charted daily prices for the past six months on the Dow Jones Industrial Average ($DJIA, $INDU, $DJI) after it closed on Friday, April 22, 2011 at 12,505.99.

This past Monday had all the markings of the beginning of a bigger fall for the Dow Jones Industrial Average. All I needed before I jumped ship was a confirmation day or two. Instead of getting that the index rebounded and by Friday reached new multi-year highs. I still wonder if the brief dip is a hint of what’s to come, but for now it’s not here. Monday saw a fall below the 10, 20 and 50 day moving averages (dma) along with a break of one of the trend line of slightly higher lows that I’ve been watching. Even the technical indicator, Williams %R, flinched.

All passed quickly enough though and now the DJIA is back above the three dma I mentioned and resumed its path above the trend line of higher lows. To my surprise, it even made it above the ascending trend line of higher highs on Friday after stopping there on Thursday to reach a new high above the psychological line of 12,500. The DJIA’s 10 and 20 dma were starting to converge and have a bearish crossover, but that may be very short lived or even averted now (although the SPX is still dealing with the same cross over). Williams %R is back to extremely high levels (maybe too high?) and points to better days expected.

Depending on which trading channel you follow, the DJIA could be close to a top if using a trend line that used to be support and then became resistance. If you go back to the longer trend line of higher lows which hasn’t broken in more than six months we might be barely in the top half of the trading channel with room to run another 500 points or so before reaching the top again. The trend lines of lower highs offer two different views also. One short line is steep and should provide support within a couple of percentage points of a drop. The other is longer and unbroken for more than six months. The latter could see the Dow drop 700+ points. That’s still only 5% or so and could be the cause for more buying as the bull market keeps working in the face of “interesting” macroeconomic factors.

Thanks for sharing and a Happy belated Easter to you too.

Regards