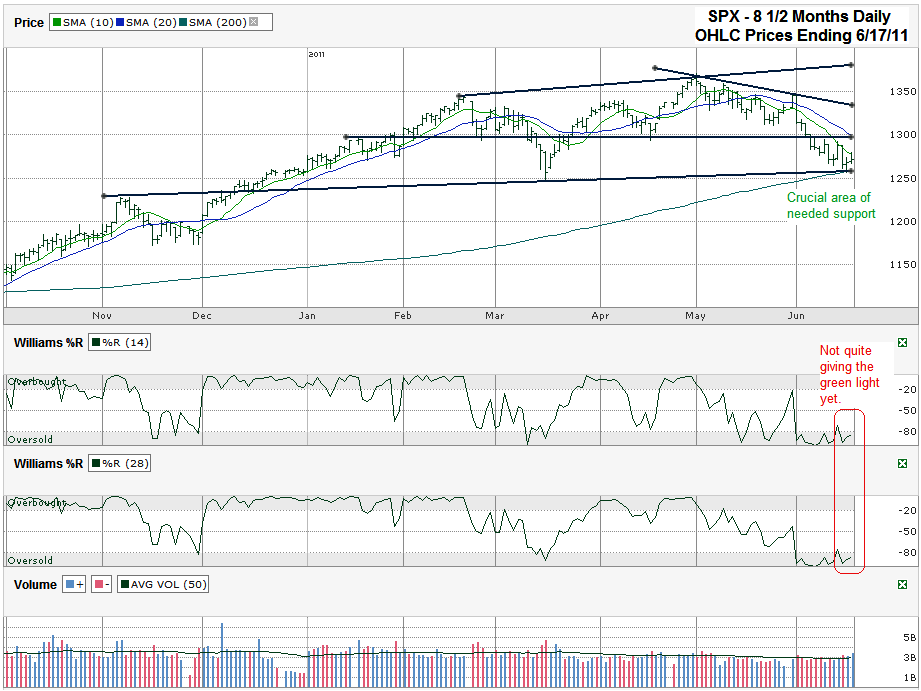

I charted the S&P 500 ($SPX) after it finished the week at 1,271.50 on Friday, June 17, 2011, just above its 200 day moving average (dma). Two weeks ago when I last posted an SPX Chart I said if we saw another 3-4% move to the downside the risk/reward would shift in favor of adding more risk. On Thursday the SPX made it past the 3% lower mark and touched the 200 dma on the same day. This begs the question, are we there yet?

The trend line of higher lows that started out as resistance in November 2010 met up with the 200 dma just a couple of days ago and offered support. This is a crucial area of needed support through next week. A break of both of these technical indicators could spell much more trouble for the large cap index. Until they break there’s good reason to think they’ll both hold, especially with the two of them working together. The other side of the coin is that the 10 dma is still acting as resistance and held the SPX down all week as this moving average continued to plummet. To have a much better case for the bulls we’ll need to see Williams %R rebound back above -80 for at least two consecutive days, preferably three to show a true momentum shift that has a higher probability of having legs.

The Williams % R indicator will be the first big change we’ll see most likely that will help us turn more bullish. Then to help us sleep better about adding even more risk we need to see the 10 dma move back above the 20 dma. I’ve been talking about this simple indicator for most of the past year as one of my new favorite signals to buy and sell. It worked on the way down on the second cross over (although I called it I didn’t head my own warning quite enough). On the way back up I plan to play much heavier in the risk-on trade once this indicator flashes BUY again. By then we’ll have seen the 200 dma holding support again (even if we break through it before then) and some of the macro-economic fear factors should have quieted by then. All of this should play out in either direction very soon, so there’s no need to rush a trade in either direction quite yet. Waiting just a few days could save some big losses and shouldn’t cost too much upside potential if the move higher comes immediately. Not that I see it as much of a victory, but I should mention that the six week losing streak for the SPX ended last week with a 0.52 point move higher on the week. A win is a win though.

Happy Father’s Day to all the dads out there.