I almost made this trade yesterday while I was thinking of it, but luckily I chose to wait a day and was able to get in with a slightly better premium on the put. I don’t think the call lost as much since it is farther out of the money. I entered this trade as two separate orders instead of waiting for a single order as a strangle to hit. A single order would be easy with the strikes closer together, but with these $13 apart separating them was easy enough. While UCO was trading at $38.98 my first limit order hit and I sold one UCO August $47 covered call for $1.00 and received $99.53 after commissions. I waited a few minutes to see if my put would hit and when it didn’t I lowered my limit price until it did. While UCO was trading at $38.95 I sold one UCO August $34 naked put for $1.70 and received $169.28 after commissions.

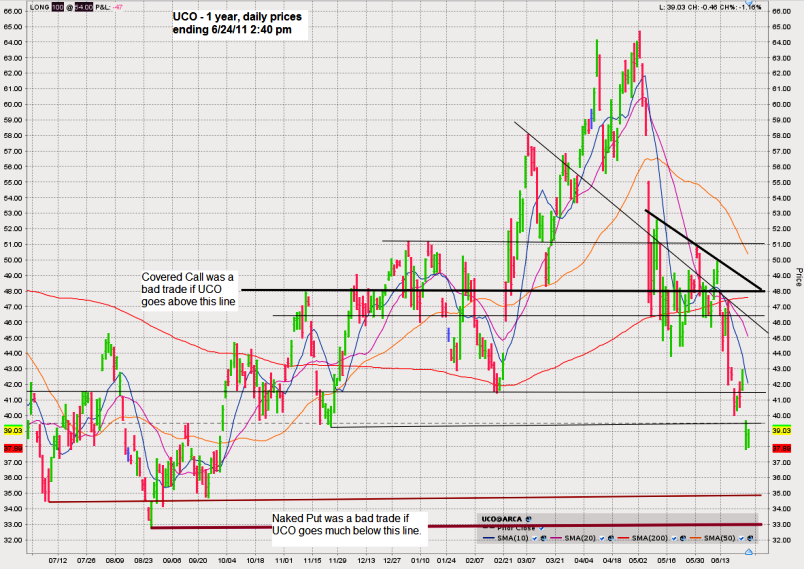

Instead of rehashing all of the logic I wrote out yesterday when I was basically talking myself into the trade, I’m posting a chart of UCO to better illustrate my trade. Clearly UCO is not a calm instrument to work with. Oil itself is volatile, but using an ultra ETF makes it act like it’s on uppers and downers every day. This makes it a great ETF to sell options on if you can handle the bumps and losses on the way to better gains. In this chart I see a hard ceiling around $51 and before that around $48. That’s how I came up with my strike for the covered call. The whole area around $46-48 looks like it could cause congestion on a rally higher. When UCO gets above $51 again I’ll probably be ready to get out and start over with a hedge in place. Notice I said “when”, not “if” in that last sentence. I have no doubt UCO will rally again, it’s just a matter of when. It could be later this year, but will probably fall into the first quarter of 2012. My trend line around $35 is slightly slanted higher since that’s how the prices last summer bottomed out. I think that range will hold again, but since I’m already in for 100 shares long now and another 100 shares I expect to be assigned in a few weeks I thought I should aim lower. The difference in premium from the $35 strike to the $34 strike was only $0.30 and I give myself another $0.70 in cushion this way. I don’t think I’ll need it, but I also thought $42 would hold and $40 too. A positive for today – after gapping lower yesterday, UCO has had an inside day today – not falling below yesterday’s low.

Assuming my July $42 calls are assigned, my cost per share will be $43.94. If my August $34 put is assigned my cost per share will be down to $40.63 (minus even more premiums from new covered calls by then). By then I’ll have 300 shares and will feel comfortable adding more still until I have up to 20% of my account in UCO. It’s not going to fall for more than a few more months at the most and with my new option strangle two months away UCO should be getting close to its bottom range. On my road to creating a much bigger long term position I’ll be very content to add more exposure to UCO with puts around the $30 range. As sure as I am that UCO will be back above $50 next year I’m even more confident it’ll climb above $40 long before that. Hanging between $30-40 I’ll be situated to sell new strangles each month or two.