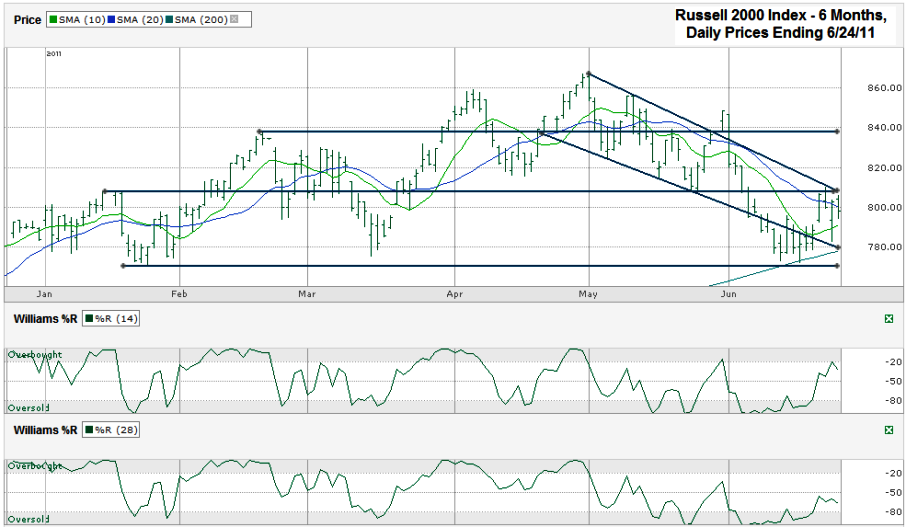

I charted the Russell 2000 Index ($RUT) after it closed on Friday, June 24, 2011 at 797.79. Just as the S&P 500 has done recently, the Russell 2000 found support at its 200 day moving average (dma) and bounced. The difference is that the small cap index bounced better than the large cap index and didn’t retrace as much of its gain by the end of Friday. While the Russell 2000 still has some hurdles to clear, it does have some positive signs showing. The first being the 200 dma is still acting as support. This came in around the same area as the previous lows for the past six months which helped provide support also. The small cap index closed above its 10 dma four of the past five days and has crossed its 20 dma intraday each of the past four days. This last point might actually be somewhat bearish since $RUT can’t make it above this moving average yet. The Russell 2000 is still in the bottom half of the trading channel it has been bouncing between for most of this year. That leaves more upside potential than downside risk when trying to determine the path of least resistance.

I’d be more bullish if the trend line of lower highs hadn’t held resistance this week and if the Williams %R indicator had a smoother path higher. This indicator is mixed too though. %R for $RUT has cleared the oversold area for multiple days which is what I always look for, but the 28 day period started edging lower on the second day above it. I’d prefer to see better momentum, like in the 14 day indicator.

We aren’t quite there yet, but it appears the 10 dma and 20 dma are on a path to have a bullish crossover before long. It’s not worth calling out until it happens, but you can see that if the Russell can at least stay flat (let alone climb any more) then the 10 dma will move back above the 20 dma within a few days. This could be the additional spark needed to push the index above its trend line of lower highs.

Either way you cut it, the showdown is coming within a few weeks between the descending trend lines and the ascending 200 dma. I’m giving the edge to the bulls for now, but am not going out on margin quite yet to take advantage of this possible buying opportunity.