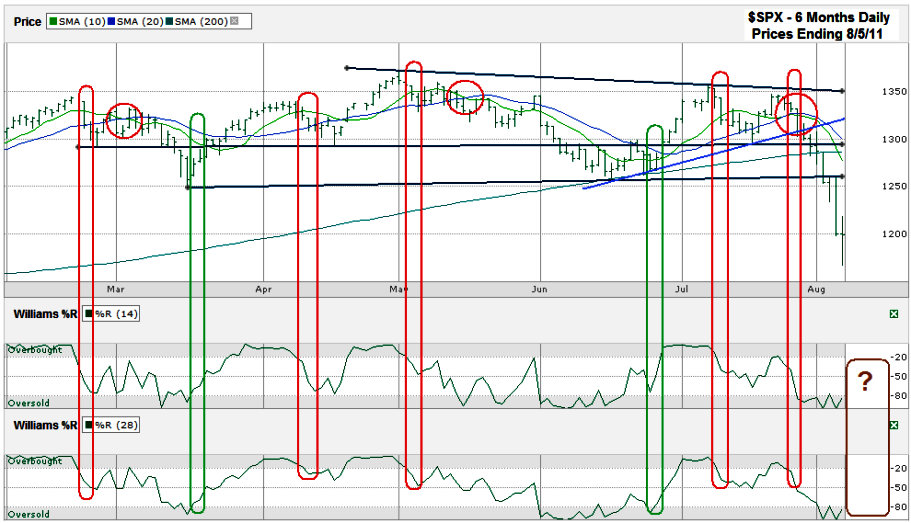

This S&P 500 ($SPX) chart shows the past six months of daily prices after it finished the week at 1,199.38 on Friday, August 5, 2011. This past week was the most painful fall for bulls over such a short period since 2008, but a lot of that pain could’ve been avoided by traders who were paying attention to the technical indicators. The chart below shows each instance the Williams %R indicator broke down from overbought levels in red. The instances where this indicator broke above oversold are marked in green. The first breakdown came in the first half of July and should have been a signal to lighten exposure. Two weeks later, at the end of July, the second breakdown hit and traders would have been wise to head the second warning to exit.

If the Williams %R indicator was not enough to cause traders to sell and secure profits, the often accurate 10/20 day moving average bearish crossover issued another sell signal at the same time. These are two technical indicators that are often good at foreshadowing what is to come. Many traders held back though. The 200 day moving average was still holding support and the debt ceiling debate was close to coming to an end. Traders second guessed the charts and clung to hope that a resolution in the debt ceiling talks would trump the technicals indicators. Instead, the short trend line (in blue) of higher lows broke two days before Congress penned an agreement. This was the third indicator that begged traders to sell. Soon after, the 200 day moving average (one of the most important indicators for a wide group of technicians) gave in and massive selling ensued. The last hope for any remaining bulls was the longer trend line of support that slightly ascended just above the 1,250 line. A stampede to sell started after this line broke.

The next potential area of support was more than 50 points lower at 1,200. Bears were able to span these 50 points in one day on Thursday before the closing bell rang. By Friday, traders started getting margin calls and were forced to sell some of their better positions that had not failed yet. This caused another intraday nosedive, but finally value seekers couldn’t hold back any longer and came to the bulls’ rescue to snap up some of the perceived cheap stocks. What’s not clear is if this is truly the end of the selling yet. The 1,200 line has already broken intraday which raises another red flag and creates the potential for one more test of Friday’s 1,268 intraday low. This area also marks the low range for the dip in November 2010 and if it breaks could take the index 6% lower to the 1,100 line.

The question on every trader’s mind is when to buy again. The charts haven’t given an all clear sign yet. At the risk of not buying at the very bottom, which is not very important in the long run, bulls might be wise to wait for Williams %R to move back out of the oversold area and even give two confirmation days above it before buying in heavily. To play it even safer, nervous investors might want to wait for the 10 day moving average to pull back above the 20 day moving average. Waiting for these two should be enough to take some downside risk off the table, but just as the 200 day moving average was support on the way down, it could play out as resistance on the way back up. Any move higher is likely not to be as steep as the past two weeks’ move lower which gives investors time to rebuild their positions without haste.

Thanks for the charts. I find them very helpful.

I don’t believe the technicals will be the main driver for the next couple months. I think the market direction will be driven emotions and the severe lack of confidence in the Fed and Obama administration. I’ve moved the accounts I manage to 95% cash and have started shorting. While the market was down 6-8% last week, my accounts were down only 0.4%. Unfortunately, I still have stock options in my company, which I continue to hold since the expirations are 1-6 years away.

I’m waiting for a Dow 10,200 before reinvesting funds in stocks. I know that seems a long way away, but I think the Obama adminstration only has one option left to improve the economy. However, the adminstration won’t likely take that action until Obama’s re-election is at risk, i.e. when the stock market and economy has significantly declined.

Thanks Super Saver. I think emotions show up in the technicals which is why I like watching them, so I agree with you on that part. I think the lack of confidence goes past the Obama administration and includes all of Congress including both sides of the aisle. The lack of compromise and name calling made both sides look stupid during the entire debate.

Spending has to be cut before we turn into a PIIGS type economy. At the same time revenue (taxes) have to be increased. I’m happy to pay more in taxes now if it will save more later, but only if it’s coupled with spending cuts. I come from the belief that paying more in taxes now will actually lead to us making even more in down the road.

The low income, low taxed masses just won’t ever make enough money to matter much for tax revenue. We have to deal with this problem now, pay more in taxes, accept less in government programs and get our finances in order. Once we’re back to a reasonable economic state we can cut taxes again and if possible increase government programs. During this whole process our infrastructure cannot be neglected though. Spending needs to continue for the near term to keep the economy moving forward. Public sector jobs have been declining for months, that’s good, but it might not be terrible to slow this decline to juice the economy a little better still. For every dollar that goes to a lower income earner that dollar will be cycled back through the economy. Estimates put this recycle at close to two times the cost for GDP growth. For every dollar I make I’m going to save $0.30 or more. That’s great for my family, but doesn’t do a lot for the economy. If I pay 2-3% more in tax I think I’d be able to make 5-6% more in a better economy. I like that math.

Don’t get me wrong, I don’t want to give away our tax dollars. I want programs that will create growth sooner than later.

My guess is that panic selling is coming soon. The 08/09 decline is still too fresh in too many people’s minds. The pundits keep saying sit tight and wait it out. But I think many more will sell to avoid the pain. People are nervous. Emotion will drive a continued decline, perhaps even below 10,000.

Of course, the challenge will be to find that bottom. I’ll be checking back to see your analysis.

Another tough day in the markets. Have you considered selling Puts on one of the companies that benefit greatly from low oil prices to hedge against your UCO position? UPS and FDX look very interesting here – I’m just trying to figure out which looks better.

Yep, today (8/18/11) sucks for bulls. I haven’t thought about your strategy Ronan, but I see the logic, but those companies would get hurt in a slowing economy. In a rising economy I’m fine.

I have thought about buying shares of SDS and DXD, ultra ETFs that track double the SPX and DJIA. I should’ve done it on Tuesday when I started getting the idea a rollover was coming. I did buy DXD in my IRA, but sold for a small loss the same day. I just didn’t trust my instinct. I’ve lost count of my lessons learned now. I think I’m well into double digits now.