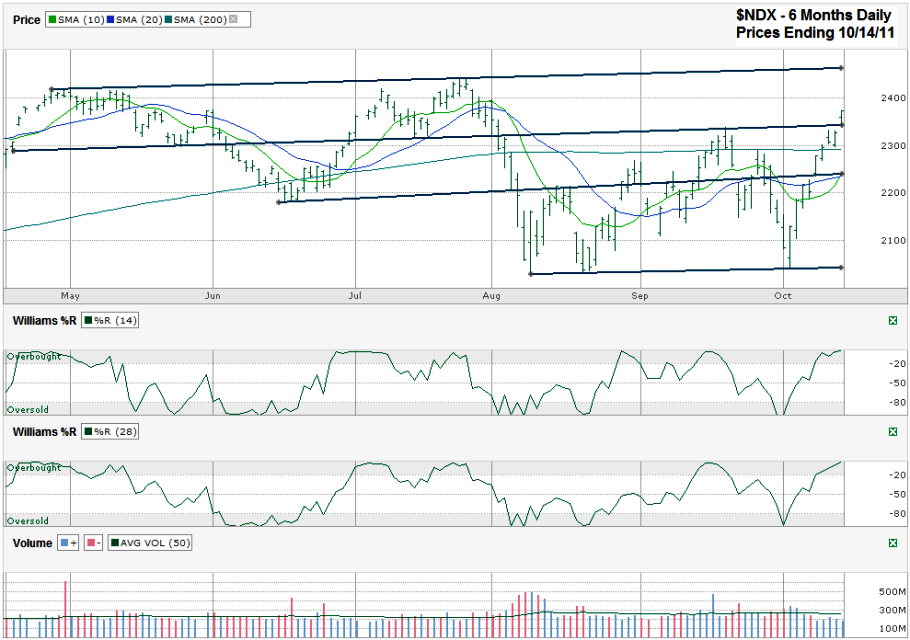

I charted the NASDAQ 100 Index ($NDX) after the markets closed on Friday, October 14, 2011, as it closed for the week at 2,371.94.

Looking back nearly two weeks you can see the NDX didn’t bottom out below its previous lows like the SPX did. In fact, every one of its trend lines I drew is ascending. The chart has other signals that are even more bullish. The two that jumped out on Friday are a crossing of the 10 and 20 day moving averages (dma) and a move above the trend line that marked previous resistance. The tech heavy index has only been above this trend line for one day, but it’s worth keeping an eye on to see if it can hold. I wouldn’t be surprised at all to see a retest of this line before moving up another leg.

The NDX flew past its 200 dma with barely a pause at all. It is worth noting though that the index is back above this moving average and the easy gains might be over for now. Upside (only considering the longer trading channel) has another 100 points or so left in it. That’s another 4+%. After such a ferocious leap from its lows asking for more than this is hard to imagine right now. A healthy index should take a breather before then and at least by then before reaching new highs. The downside could be limited (outside of another major macroeconomic event) to the trend line that starts from the June lows and is currently around the 2250 area. That’s about 5.5% lower and will be met by the 20 dma for additional support around there. The 10 dma will be much higher based on the ascent it’s on right now.

Williams $R literally fell off the bottom of its indicator for the 14 day period and then flew out of the oversold section like a rocket. Now that it’s in the overbought area it can stay there for a while. Like always, keep an eye on it for a move below this section to get the next sell signal. The biggest footnote for the bulls’ celebration is the weak volume seen during this rally. The NASDAQ 100 Index hasn’t had volume even up to the average line in more than a week. Lower volume can make bigger moves easier with fewer traders playing the other side. Either way, the gains and losses still count for those who capture them. It’s just worth noting that they might not be as sticky when volume returns.