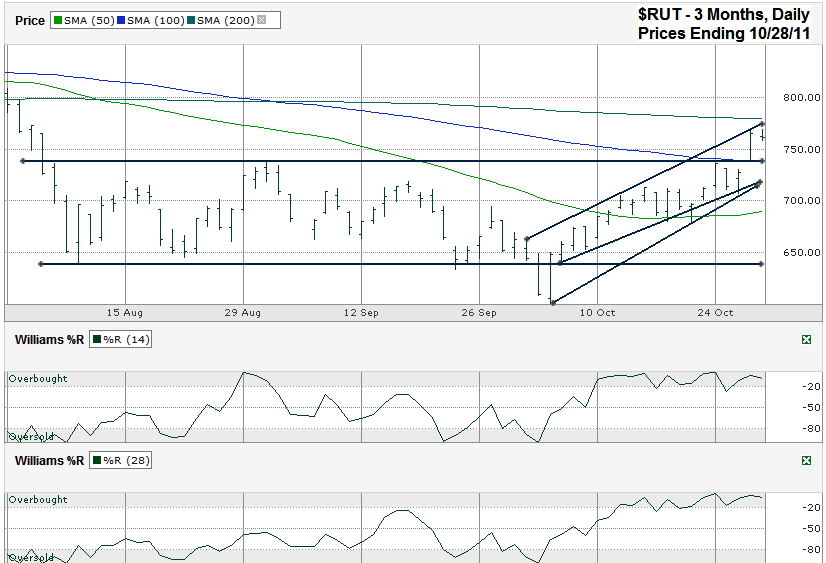

I charted the Russell 2000 Index ($RUT) after the markets closed on Friday, October 28, 2011, when it closed for the week at 761.00.

On Thursday, the small cap index broke above the trading channel it has been stuck in for nearly three months. The low for that day was in line with the previous top of the old trading channel. Watch for this line to be new support now that resistance has been broken. As luck would have it, this line coincides with the 100 day moving average (dma) for now. The two technical barriers should work well together to strengthen support, but be mindful that a break here could send $RUT back into the lower trading range and maybe back to its 50 dma below 700. I’d be surprised if we see a move back to the bottom of the trading channel below 650 in the near term, but major trouble in Italy or Spain could be a spark that does it. The markets are too fickle these days to believe support can be rock solid.

If support does hold above the 100 dma then the 200 dma will be the next hurdle the small caps have to deal with. The current ascending trading channel shows a likely sideways to lower move is likely in the coming days, but after the lower side of this trading channel catches up the trading channel will have opened up room above the 200 dma and that’s where the next really big gut check will be for the bulls. It’s hard to want to open a new position above 750 for at least two or three more days. The next buying opportunity should light up the screen when support is held at the 100 dma. If another small dip doesn’t hit $RUT then buying above the 200 dma could be another good entry point. Buying before either of these indicators is triggered is risky after such a strong October.

The Williams %R indicator for both the 14 and 28 day periods still shows strength while it remains in the overbought area. Monday doesn’t appear to be in danger of triggering sell signals, but if Tuesday produces a third day lower in a row it might be time to take some profits. It all depends on how steep the losses are each day.