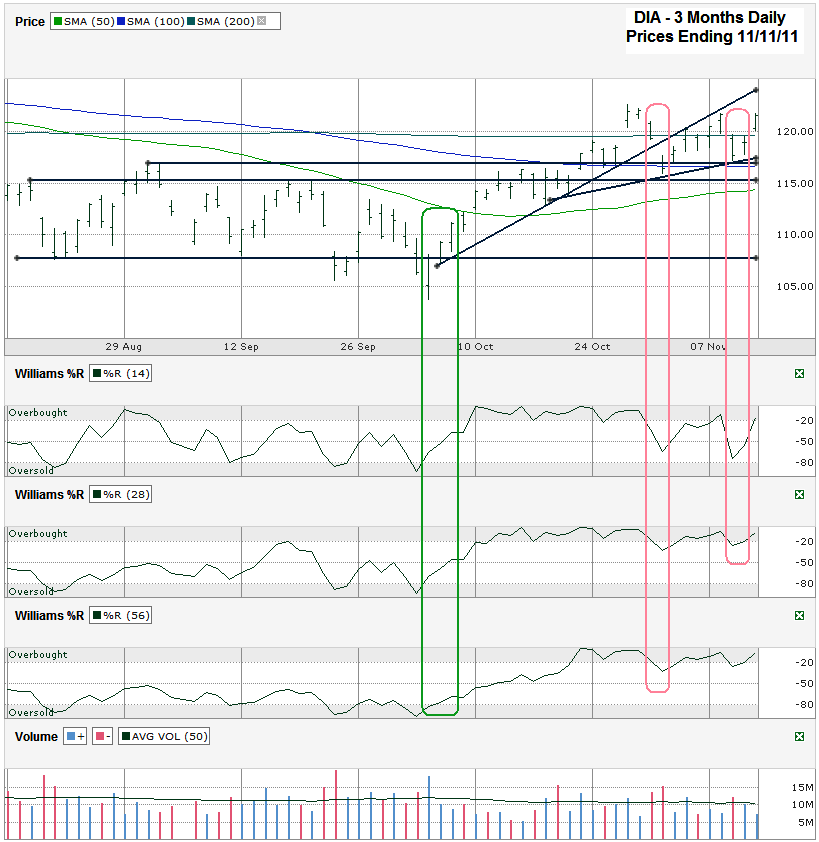

I charted DIA, an ETF that tracks the Dow Jones Industrial Average ($INDU, $DJI, DJIA), after the markets closed on Friday, November 11, 2011, as the Dow closed for the week at 12,153.68 and DIA closed at 121.53

(I had to pull the chart for DIA this weekend because TD Ameritrade isn’t pulling up prices for 11/11/11 for me on any indexes. DIA works and the price action is the same, so that’s what we have today.)

DIA made a very bullish move on Friday when it gapped up above its 200 day moving average (dma) which is currently close to 119.55. Any gap higher is usually viewed as bullish, but launching above the 200 dma made this one extra sweet, especially after Wednesday and Thursday saw resistance at the very same moving average. However, this isn’t DIA’s first trip above its 200 dma, so risk isn’t quite off the table yet. As with most technical indicators, one day does not make it a complete buying decision yet. It’ll be much more bullish if DIA can retest the 200 dma and then move higher again. It hasn’t done this since back in June.

Below the 200 dma, support could be found at the 50 or 100 dma, around 114.50 and 116.50 respectfully. Horizontal trend lines support both of these moving averages and could aid in support if they come back into play soon. To the upside, DIA still faces resistance at its intraday high of 121.75 from Tuesday and 122.58 from 10/27/11. Once these break to the upside bulls could be set for another leg to this rally as additional short covering will play its part by then too. Williams %R gave little head fakes twice recently, but neither instance had a second confirmation day (third day lower) to cause a reason to sell. Bears could argue that volume was weak on Friday and the rally isn’t worth much, but those who took profits on Friday afternoon would counter the prices still paid out.

With news of Italy’s Berlusconi stepping out of the way this weekend, the markets are poised for another leap higher, but be ready for another test of the 200 dma no matter what. The bears aren’t going to rollover that easily and the world’s problems aren’t over yet.