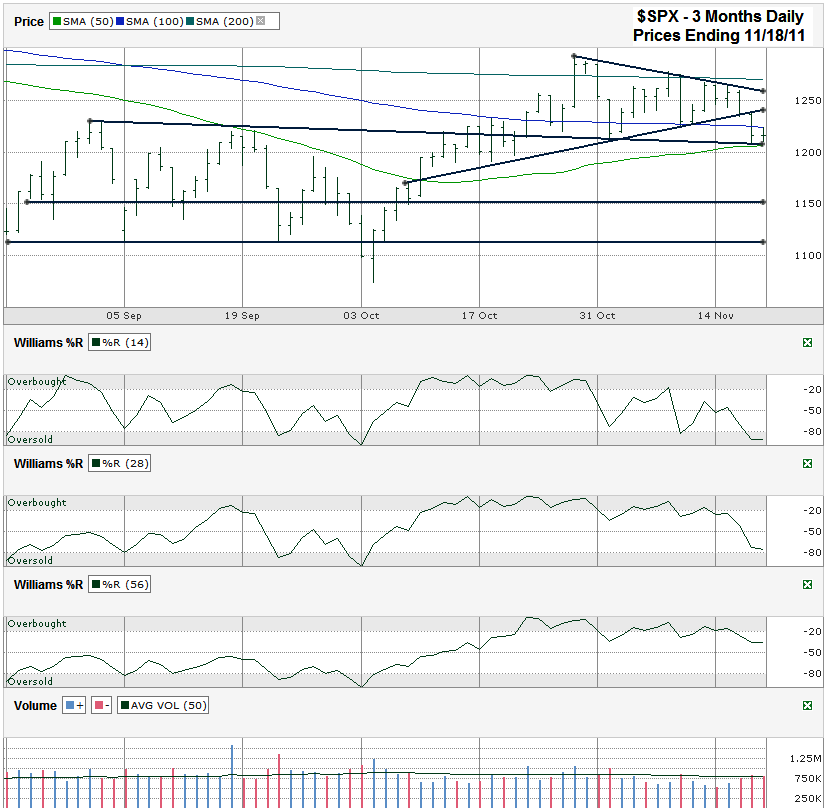

This S&P 500 ($SPX) chart shows the past three months of daily prices after the index finished the week at 1,215.65 on Friday, November 18, 2011.

The technical indicators are piling up to create a strong bearish case against the large cap index. The 200 day moving average (dma) held out as resistance yet again as the market couldn’t push above it for more than a few hours on its second attempt above the line. On the next test at the moving average the SPX never even made it above it and that’s when the selling ensued. This failure at the 200 dma came at the same time as the trend line of lower highs maintained its unbreakable resistance. The always bearish 10/20 dma crossover (not shown) showed up a couple of days later and then the 100 dma broke too. The break of the 100 dma also came as the trend line of higher lows broke. This bottom part of the ascending triangle was crucial to hold and when it gave in to start the day on Thursday the bulls couldn’t find a reason to buy even if they wanted to. The bears were in control officially by then.

Two points of hope are available for the bulls to cling to for now. The 50 dma hasn’t broken support yet after being tested for the past two days and the longer trend line that was once resistance and is now acting as support has still held. This trend line is descending and as it melts will fall below the 50 dma. This will create an opportunity for the latter to fail, but the former to hold for a little while longer. The 1,200 line is occasionally worth watching, but only because it’s a round number. Support and resistance only tend to be seen as a speed bump along the way.

Williams %R has given more mixed signals since the summer began than it usually does when viewing the 14 and 28 day periods. They’ve still been accurate most of the time, but like any indicator, have proven they aren’t perfect. The 56 day period has been more reliable and is not showing a favorable view for the bulls. Another day lower within the 56 day period and we’ll see a much stronger choke hold held by the bears as the bulls cower farther out of site. Volume has been nothing to write home about for either side, but I kept it in the picture for those readers who still like to keep an eye on it.