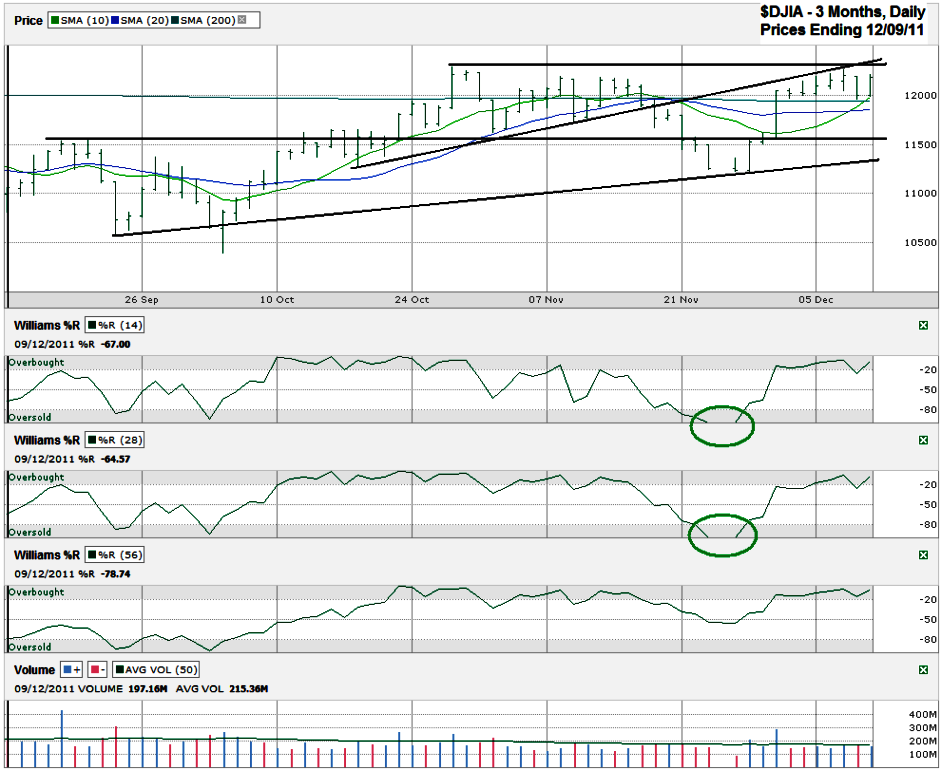

I charted the Dow Jones Industrial Average ($INDU, $DJI, DJIA), after the markets closed on Friday, December 12, 2011, after the Dow closed for the week at 12,184.26.

After the Willliams %R indicator fell off the bottom of the Dow chart for the first time I can remember ever the index came shooting back like there was no issue in Europe and all worries were for nothing. Just seven trading days after hitting a recent intraday low the Dow added nearly 10% before hitting resistance around the highs of late October. The fallout from not moving past this previous high only lasted a day and then the bulls came back in to resume their buying efforts.

The bump on the head from resistance shouldn’t have come as a huge surprise. The previous trend line of support had been acting as resistance for the prior week’s ascent and just gave the horizontal line extra fire power. Now that the Dow took a breather for a big down day on Thursday it can return to its bullish ways. The horizontal resistance area around 12,255 – 12,285 still poses a threat, but the ascending trend line of higher lows has moved on and gives space for the DJIA to advance.

The moving averages are playing their roll for the bulls’ case too. The 200 day moving average (dma) acted as crucial support on Thursday which is a strong buy signal. At the same time the 10 and 20 dma had a bullish crossover which is one of my favorite indicators to promote a reason to buy, along with Williams %R. That said, volume probably won’t have more than a single day above the moving average until the horizontal line breaks and the index has fewer technical headwinds.

However, the downside risk isn’t small from here. A retest of the October lows is still on the table, just as is another bounce off the trend line of higher lows. Keep an eye on the moving averages. Each one could act as support and every time one gives in to selling pressure the more likely a much bigger sell-off is in the cards. For now, the bulls have the momentum and could carry it through the end of the year, but that could spell out a nasty quick correction in January if the buyers get too far ahead of themselves while chasing performance.