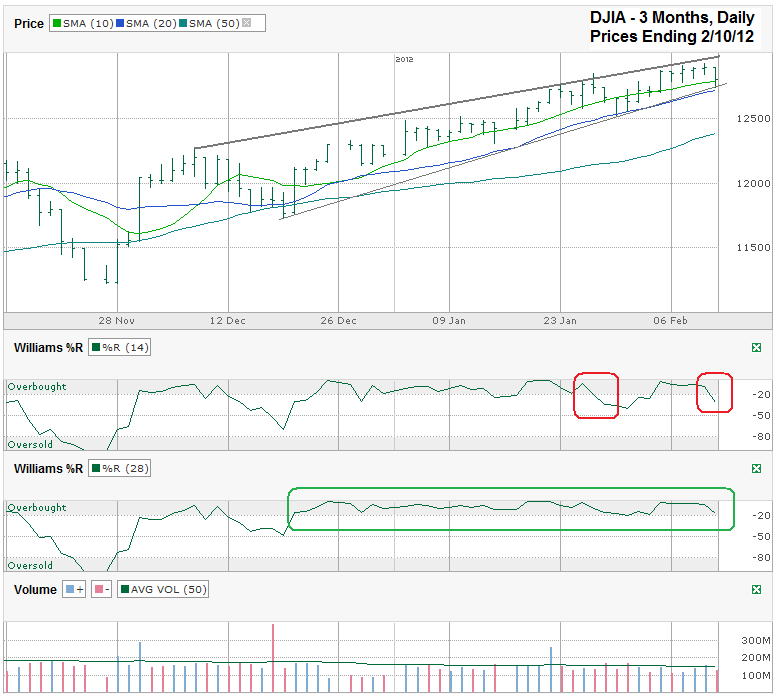

I charted the past three months of daily prices for the Dow Jones Industrial Average ($INDU, $DJI, DJIA) after the index closed at 12,801.23 on Friday, February 10, 2012.

Two weeks ago when I last charted the Dow, I suggested the index might have one more trip to the top of its trading channel before rolling over and falling outside of its trading channel for the first time since the beginning of December. On cue it rallied to the top, kissed the upper trend line of higher highs and moved sideways until Friday when it took more of a jolt. Now it’s testing a few technical indicators and is on the brink of a bigger fall.

On Friday, the 10 day moving average (dma) broke again intraday, but the INDU pulled back up to finish barely above the moving average. Any intraday break like this is usually a warning that the trend is weakening, but that hasn’t been the case over the past two months. The 20 dma has been more solid in its support and that strength worked again on Friday, right where the trend line of higher lows met with it. I drew this trend line thin to try to keep both visible. These are the main technical indicators to watch right now. When they break, the Dow should lose another few percentage points quickly from there.

That day can’t be much farther down the road. The two sides of the trading channel are drawing closer together and will converge soon. That means both sides can’t “win”. After such a long and steady rally, the bears will have the edge here. Once these indicators give up support we should see a drop in the Williams %R indicator too. The 14 day period has started to drift lower, as it did two weeks ago, but the 28 day period hasn’t fallen below the overbought range yet. Until that happens I don’t see a solid reason to sell.

The next stop to the downside could be at the 50 dma, less than 4% below last week’s intraday high. That might be all the buying opportunity needed to bring in more cash from money market accounts that have been waiting for a better entry point. I want to see support there before buying in deeper, just in case it gets worse.