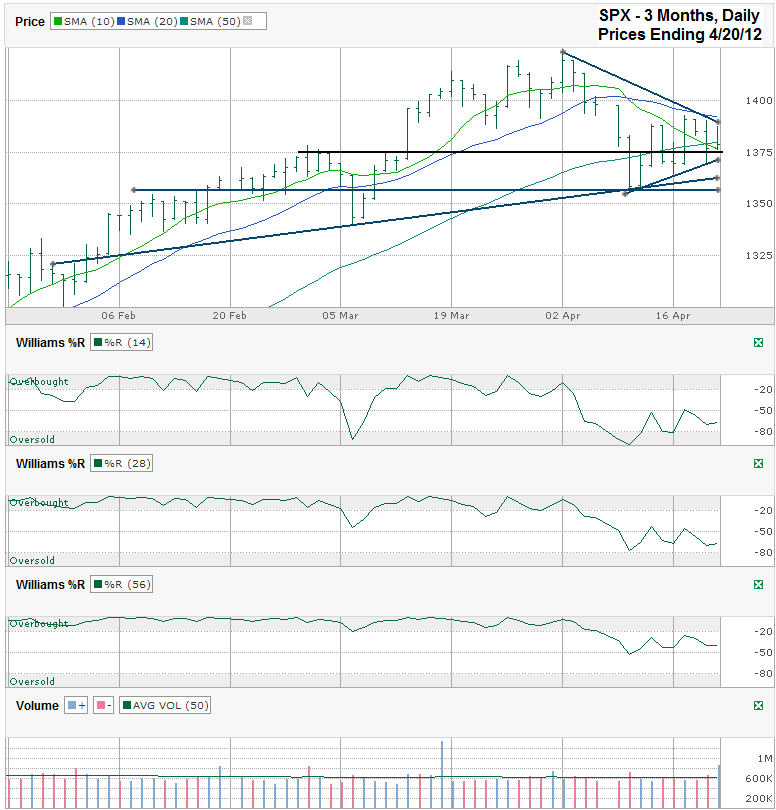

This S&P 500 ($SPX) chart shows the past six months of daily prices after the index finished the week at 1,378.53 on Friday April 20, 2012.

A couple of weeks ago I questioned if the “Sell in May” crowd had started their annual exodus early. Since then the market fell a few percentage points, but then recovered quickly. As of Friday the SPX is only down 20 points from when I questioned the bulls’ strength. Friday’s chart isn’t as clear as it was two weeks ago.

Williams %R came out of the oversold area and stocks rose, but the 20 day moving average (dma) acted as resistance and pushed equities lower again. The 50 dma hasn’t been much help as it has been crossed intraday eight of the last nine days without causing much more than a very brief pause. The 10 dma held support on Friday, but it also just crossed below the 50 dma. This is often (not always) a bearish signal. These basic technical analysis tools are more neutral right now than anything else and force us to turn back to trend lines for better forecasting.

The bearish trend line to watch comes from the relatively short trend line of lower highs. It blocked further advancement on Thursday and Friday and will be key to breaking before a new lurch forward is possible for the index. The bulls need to watch the slowly ascending trend line of higher lows that started in early February. It isn’t far above the intraday lows from a couple of weeks ago and is ascending at a slope not so aggressive that it has potential to hold. Before that can happen, 1,375 might be interesting to watch. It has been crossed a lot, but has been support and resistance a few times too. As coincidence would have it, a short trend line of higher lows and the aforementioned trend line of lower highs might converge close to it. At the same time, many technicians want to see a successful test and support of the intraday lows from April 10th around 1,357. If this upper 1,350s area holds, the market should be poised for a solid rebound. If not, 1,325 looks like an easy next mark on the chart and 1,300 isn’t out of the question. After all, May is only a week away.