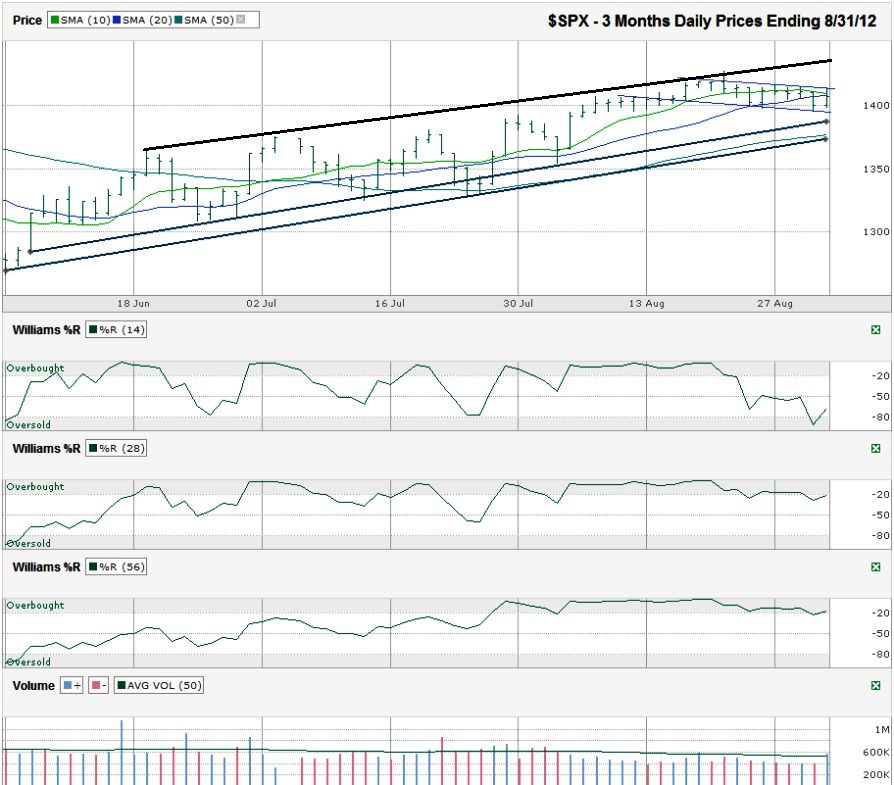

This S&P 500 ($SPX) chart shows the past three months of daily prices after the index finished the week at 1,406.58 on Friday, August 31, 2012.

The movement lower might not have much deeper to fall. Two long trend lines of higher lows are within 1-2% below Friday’s closing level. The 50 dma is right in that mix and could offer further support too. The Williams %R technical indicator already signaled sell in the 14 day period after momentum began to shift in favor of the bears. The 28 day indicator began to break, but did not get a confirmation day yet. The 56 day indicator is always slower to react and still shows longer term momentum favors the bulls. If the 56 day indicator breaks below overbought for 2-3 days, it will also mean that the 10/20 dma bearish crossover has occurred and possibly that the trend lines of higher lows broke support along with the 50 dma. In other words, by the time the 56 day period breaks, we should have already cut our bullish exposure.Two weeks ago, I pointed out that the SPX chart showed it was likely to stop its ascent. Since then, the index has drifted lower in a tight trading channel, not with any true conviction, but decline still cost bulls some profits. On Thursday, the S&P 500 closed below its 10 and 20 day moving averages (dma) for the first time since July, but on Friday, it rebounded. The bounce moved it above the moving averages, but above the descending trend line of lower highs. This slog lower has the 10 and 20 dma at the point of a bearish crossover if stock prices don’t move higher again quickly. If the moving averages don’t cross over completely, traders will consider it a bullish signal and we should see the SPX head back towards its longer ascending trend line of higher highs.

Either way it’s sliced, the recent price action hasn’t shown a blow out top and is unlikely to produce much of a gut wrenching correction. A long, steady decline is much easier to manage with options than panic selling is. The trick is not to panic, but to keep watching the charts and understanding the side rails for the SPX. As this weekend marks the end of the summer, volume should start to return next week and we’ll have a much better idea of how the rest of September should look.