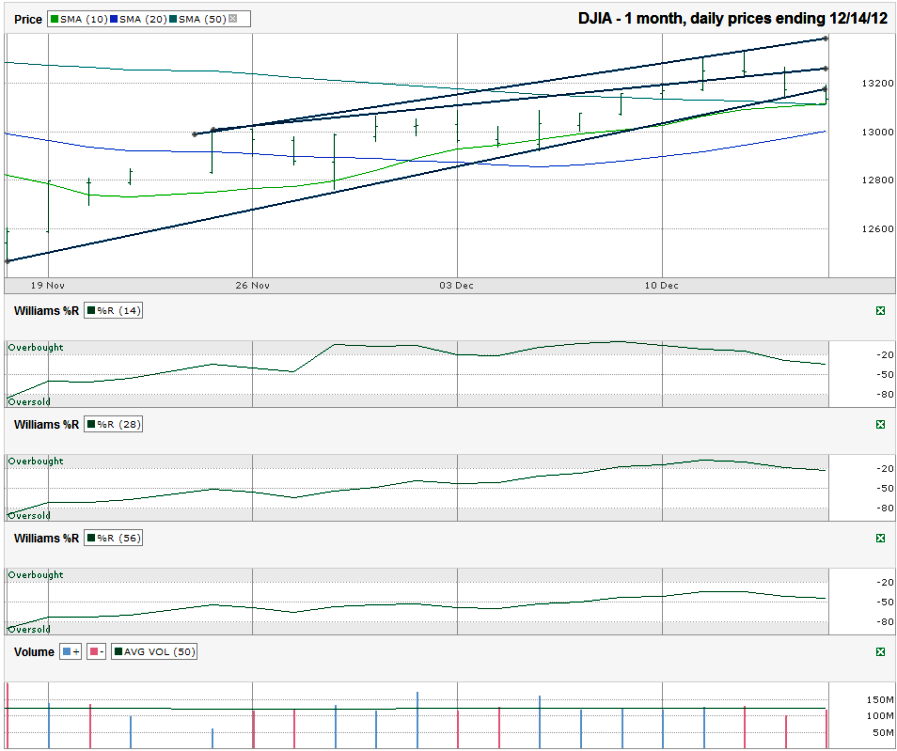

I charted the daily prices for the past month on the Dow Jones Industrial Average ($DJIA, $INDU, $DJI, the Dow) after the index closed at 13,135.01 on Friday, December 14, 2012.

This week I zoomed in on only the most recent month. I wanted to highlight the moving averages more than anything right now. The 10 day moving average (dma) is showing a bullish crossover above the 50 dma and the 20 dma is on its way for its move above the 50 dma. However, the 20 dma is also playing catch-up to the 10 dma. The DJIA found support at the intersection of the 10 and 50 dma on Friday. This is the most crucial area to watch for now. Both of these lines need to continue holding support as the last days of the year tick off. An intraday break that sees the 20 dma hold support wouldn’t be the end of the market, but it would raise red flags for the cautious investors out there. It would show a real shift in momentum.In the past couple of weeks of index charts, I’ve questioned if this rally was “for real” and “what’s not to like?” The indexes barely moved higher over the past couple of weeks as the worries over the fiscal cliff have held buyers from jumping on the rising tide.

The shift can already be seen in the Williams %R indicator too. The 14 day section shows a sell signal and has one confirmation day as a stamp of validity on it. It needs two or three stamps to make it worth a trade. That’ll only come if the 10 and 50 dma break support this week. Once again, the technical indicators are working in unison to foreshadow bigger moves.

The caveat remains to be the fiscal cliff discussions. Until recently, the consensus was that it would go until the end of the year (and maybe up until Christmas for those who still believe in Santa Claus) and be resolved with a splash of drama. Traders are beginning to question that theory and are starting to trade like we might have a short fall off the cliff before any resolution comes about. The majority of traders are acting like any dip will be short lived and aren’t jumping ship yet because they don’t want to miss the rebound. Others believe the resolution, whenever it comes, will be a sell on the news event. There’s no telling who is right, but the charts don’t say sell yet. I’m staying cautiously optimistic, which means I’m staying net long, but hedging the worst of it in case the stupid game of “chicken” ends with the destruction of both sides.