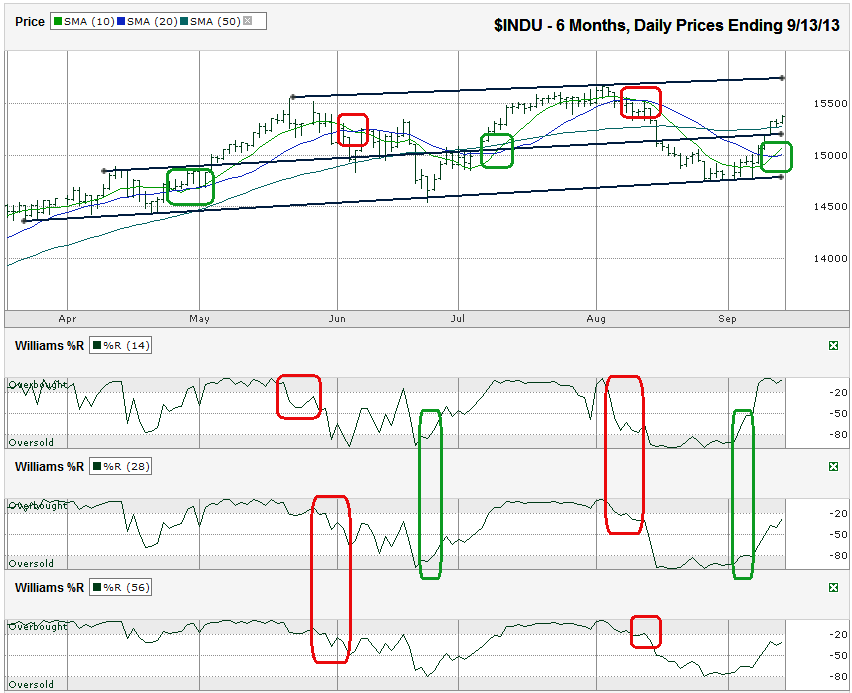

I charted the daily prices for the past six months on the Dow Jones Industrial Average ($DJIA, $INDU, $DJI, the Dow) after the index closed for the week at 15,376.06 on Friday, September 13, 2013.

The first bullish indicator was seen from the trend line of higher lows over the past six months. The Dow dropped quickly through August, but flattened out along this trend line while in consolidation. Once the index cracked through the 10-day simple moving average (sma) resistance, bulls had a reason to wake up. The wake-up call was echoed by the Williams %R indicator. Both the 14 and 28-day indicators moved above oversold to show momentum had shifted. The 56-day indicator never made it to the oversold range. In fact, the 56-day indicator hasn’t shown oversold since November 2012. Just a few days later, the DJIA’s push higher brought the 10 sma above the 20 sma for a bullish crossover. The feared resistance at the 50-sma didn’t slow the momentum as the bulls were clearly in charge again. The 50-sma acted as support the day after it broke support and this added to the bullish enthusiasm.Along with simple trend lines, moving averages and Williams %R are my favorite technical indicators. They don’t always work to predict the future, but they usually do and can be fantastic timing tools. A month ago I used these indicators to point out the DJIA was in a downtrend. It retreated on queue and those who heeded the warning saved some money. The reverse showed up recently and should mark the beginning of the next upward swing.

That brings us up to date. The moving averages, trend lines and Williams %R are lined up for better gains. A pause to consolidate for a few days would not be shocking here. Watch the 50-sma to see if it holds support. If it doesn’t, the 10-sma is racing higher to lend a hand and should be close to the middle trend line within a few days, just in time for the Fed’s announcement on tapering.

The upside push will have to get through the early August high of 15,658 and then has the trend line of higher highs to deal with a few points later. Depending on macroeconomic news in the coming weeks, this is going to be a harder line to cross. Traders shouldn’t be surprised to see the DJIA continue trading within the wide trading channel established over the past few months, but should be ready for a breakout on positive news.