Options expiration days have grown into a non-event for me lately. Once again, I have no options remaining on the last day to trade them. This tendency to close my positions early evolved over the past few months. Part of it has come from having options that are either close to or out-of-the-money. Before long, possibly next month, I’ll have one or two positions in-the-money at the end of expiration. That will be the case unless I take my profit or loss early due to a change in how I see in the economy. I’m content to let the time value on the options melt away while we wait and watch to see if the recent retreat from the highs is more than a consolidation.

Small cap stocks, as seen through IWM, a Russell 2000 index ETF, have moved well beyond their consolidation phase and are sitting at the edge of the definition of a technical correction, 10% below its highs. That fall has pushed one of my leveraged ETF naked puts in-the-money. UWM is trading at $74.55, while I have two July $77 puts I’m short. That’s in addition to two more UWM July $70 puts I’m short. As you can see below, both of the UWM puts still have a lot of time value left in them. I might close one or both of these pairs of puts early, but with so much time value remaining, I want to wait until closer to expiration to see if the slide lower stops and the calendar helps to erode more of the premium. If UWM falls another $5.00, I’ll be within a few cents of break-even on the two different strikes. If UWM doesn’t fall much further, I’ll pocket a profit. Of course, I’d prefer UWM to gain 3.3% before the July expiration so I can take a full profit on both strikes. That’s only about 1.7% of upside for the Russell 2000 index and is very possible. I like how IWM and RUT bounced off their lows yesterday and today and am encouraged that the worst of the selling could be over.

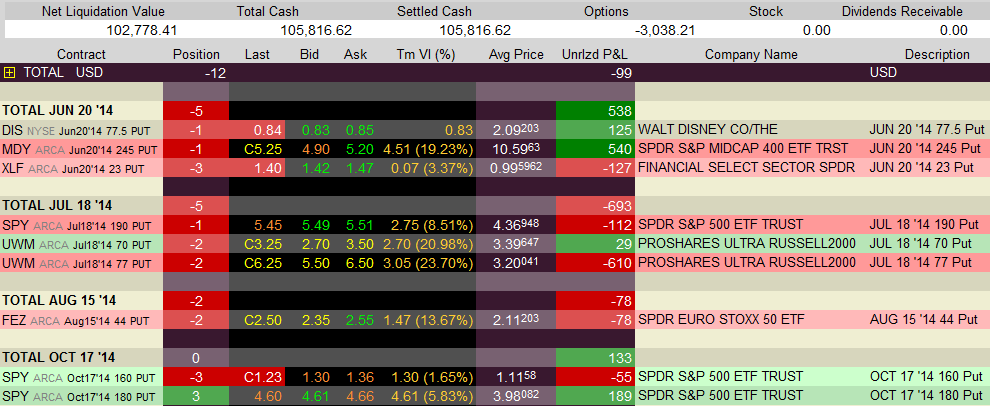

My June options look OK when taken together, but XLF could be my problem child. I have an alert set to watch the Financial Sector SPDR and if it falls below $21.50, I’ll probably close it for a loss. MDY has a lot of time value remaining and less than $0.50 in intrinsic value (the amount in-the-money). DIS is still out-of-the-money and I’m still thinking about selling another naked put on it. I’d like to see a little more weakness in the stock or a reversal from the current price before I sell the next put on it.

July doesn’t look good for me at all, unless stocks recover over the next nine weeks. I mentioned my UWM puts above and my only other July position is on SPY, which is in-the-money by almost $3.00. Although the option shows a paper loss right now, if the S&P 500 ETF flattened out or even dropped one more dollar, I’d be back to a profit after the time value vanishes.

The Ford (F) puts that I bought back earlier this week look like they would’ve cost me another $0.02 each to close today. So I did the right thing by exiting when I did, not that an $8 difference (.02*400) is anything to brag about. The other trade I made that day on FEZ wasn’t timed quite as nicely. FEZ is down $0.60 from where it was when I rolled out my puts to August. I could’ve sold the calendar spread for $2.35 (instead of $2.12) today and if FEZ stays above $43.00 through the end of today, I might have been able to get $2.40-2.45 for the August $44 puts on their own while I let my May $43 puts expire worthless. This shows that there’s no method that works every single time. If FEZ had run higher, stay flat or even dropped just a little, my early roll-out would’ve been the more profitable trade.

I consider review sessions like this extremely important and highly recommend every reader take the time to think about each single position in their portfolio on a regular basis. Before making any trades following the review, consider how the portfolio as a whole looks and works together. For example, I might be tempted to dump my three July positions, but since I have the SPY hedge in October, I don’t need to panic. I have room to let things play out. Since small caps are moving lower much faster than SPY, my hedge might not do a ton of good for me in the short-run.

I bought the SPY spread one day before SPY peaked at an all-time high and I’m very happy that I did. I still have another 4% or so before the ETF falls in-the-money and by then, value investors could start swooping in again. In the meantime, I’ll be able to relax more, knowing I’m protected from a brutal loss if the selling intensifies.

This is a screenshot of my positions as of about 1:30 today. You can see my cash value is up to $105,816.62. This would be my account value if all of my options expire out-of-the-money. I don’t expect that to happen, but also will make more trades and bring in more cash before any more of these options reach expiration.