Once again, I have no options expiring today. I haven’t even made a trade in weeks. So, I’ll give a portfolio update instead. I was planning to sell covered calls on my IWM, MDY, DIS shares, but the charts showed a lot of upside available and I waited. Now, I’m thinking about it again and will probably get to it next week. I might buy a put spread to help hedge my IWM position too.

TLT is still my biggest account influence. My balance fluctuates daily in large part due to the price of TLT. The big debate I’m having now is if I should sell my hedges and cut the losses I expect to have from the time value erosion between now and May expiration and then to the June expiration too. Days like today, when TLT rallies and I save $1,650 on paper, make me want to stay long with these hedges. My other option (no pun intended) is to sell new calls above my hedges. I’d have some risk added, but would still have my hedges in place if TLT only pushes a little higher. I also might sell more puts. My TLT May $125 puts have gained nearly $1,200 so far and have little time value left. By rolling these puts up and out, maybe to the June $126 or $127 strike, I’d bring in good premiums, but would cut my profit potential for TLT’s eventual collapse.

I know I’m going to roll my short TLT May $126 calls at some point before the end of April to avoid another option assignment. I don’t know to what month I’m going to roll them or to what strike. I don’t gain much by only rolling a month out, so July is the more likely expiration I’ll go with. September is too far out to consider right now. I don’t know if I’ll stick with the $126 strike or the push up to the $127 strike. The $127 strike has slightly less risk, but probably not enough of a difference to give up the upside potential I’ve been waiting for.

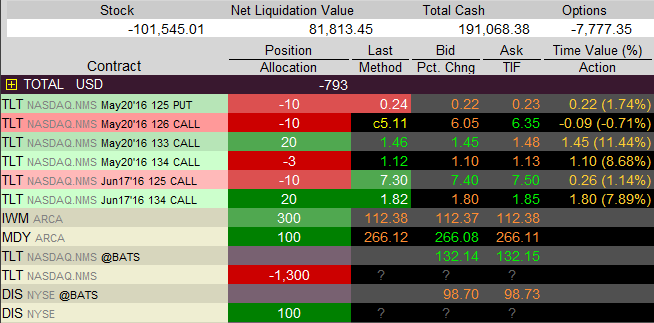

This is what I have in my account right as of around 11:00 this morning. The quotes for TLT and DIS are on a separate line because I don’t pay extra for NASDAQ and NYSE real time quotes and find it easy enough to insert quotes from my BATS feed.