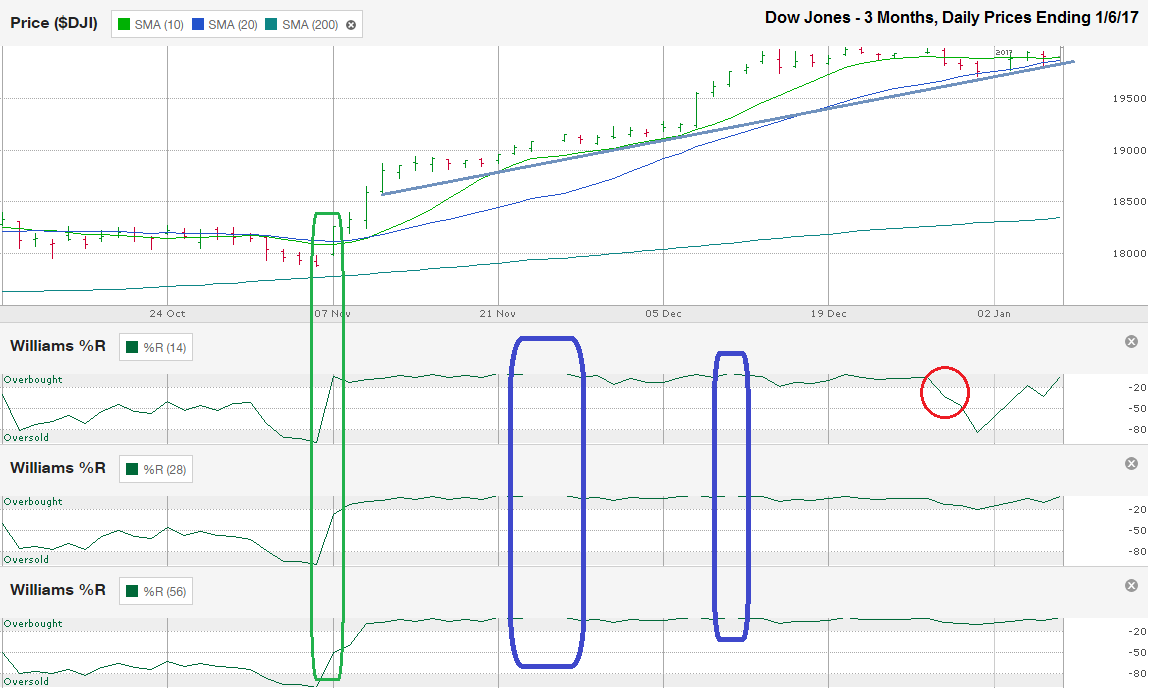

The chart below shows the daily prices for the past three months on the Dow Jones Industrial Average (aka $DJIA, $INDU, $DJI) after the index closed for the week at 19,963.80 on Friday, January 6, 2017.

The Dow has gained almost 9% since the election as animal spirits took over trader sentiment for a month and a half. However, the large cap index has failed to push above the round 20,000 barrier that has no significance other than it has four zeros and the press likes round numbers as targets. These large round numbers always draw a lot attention on the news, perhaps because it’s a way to draw in viewers and readers, but their efforts end up making the number matter, if only until the trading algorithms can work past it and a more worthwhile headline can take its place.

The normal trading pattern that occurs when nearing a round number is for the first one or two attempts to fail before the bulls can finally push above the otherwise meaningless barrier. The current pattern has played out according to that script so far. After coming within 13 points on December 20, the Dow moved sideways for a few days before dropping as low as 19,718 on December 30. The small late December dip was enough for a reset and on Friday, the Dow reached a new all-time high of 19,999.63 before losing steam. We’ll know soon if the second attempt to break above 20,000 results in failure and if traders need one more reset before they can push through into the 20,000s.

Technical indicators can help foreshadow the future prices of individual stocks and indexes. The Dow stayed above its 10-day moving averages from the election until December 28 when it fell below its 10-day moving average and closed below it for four consecutive days. On December 30, it dipped below its 20-day moving average, but has not closed below this longer-term moving average since the Friday before the election. Intraday crossings of a moving average can raise warning signals, but it is the closes below the moving averages that holds more significance. For the past three days, the Dow has closed above both moving averages as it has held in a consolidation pattern, refusing to rollover or break higher.

The single trend line I drew in this chart shows the line of higher lows that began on November 10. This trend line has been the guide for bulls to follow when the bears try to push prices lower. They’ve used the guiding line as re-entry points on every hint of weakness. Eventually the line will break and that’s when bears will be able to have a longer run, especially since a break in this trend line will also coincide with a break in the moving averages covered above. The combination of the multiple technical indicators signaling at once increases the probability they will be accurate predictors of future prices.

Technical indicators work until they don’t. None is infallible. The Williams %R indicator proved this point in November and December. The two areas I circled in blue include periods when Williams %R was literally off the chart for being overbought. Typically, the index will falter two days after such a rare event. Neither occurrence produced any weakness on these days. Williams %R was accurate the day before the election when it moved above its oversold region (circled in green) on its 14, 28, and 56-day indicators. Moves out of either oversold or overbought on all three periods indicate a change in momentum and are usually accurate. In late January, the 14-day indicator fell below its overbought range (circled in red), but the 28 and 56-day indicators didn’t echo the sell signal and the Dow stayed elevated.

Traders can use these three technical indicators as a guide to when the bulls will step out of the way and yield to the bears temporarily. When this happens, the Dow could retreat as low as 18,345, where the 200-day moving average is ascending slowly. Before falling that far, it will have to get through its 50 and 100-day moving averages (not shown), currently at 19,180 and 18,738 respectively. Each moving average is likely to give reason for pause, but until support is clear, don’t bank on it being more than a speed bump during a deeper slump.