Immediately after my order hit to sell my TLT naked calls, I entered another order to close the calls if/when TLT fell to $1.10. I chose $1.10 as my exit price because it was above the round $1.00 price that I thought might have heavier competition with orders and I’d finish the trade with slightly more than a $400 gain.

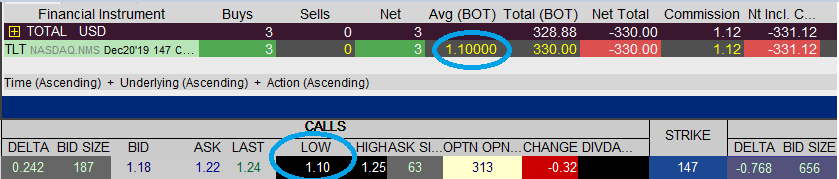

While TLT was trading at $139.89, I bought to close my three TLT $147 naked calls for $1.10 and paid $331.12 including $1.12 in commission. Since I received $733.71 when I sold these calls 10 days ago, I earned a realized gain of $402.59. By using a well-placed limit order, I was able to get the low trade of the day when buying back these calls. (See the pic below.) The drop below $140 for TLT lasted less than a minute, which is why having limit orders in place is crucial for trade management.

I’m still confident that these calls will finish worthless by December options expiration, but I thought it was wise to take a profit in a week and a half if I already gained more than half of my maximum potential.

Ideally, I’ll be able to trade on the December contracts again before I have to move on to January or later. I think most traders will agree with me that there is a slim chance for us to have clear sailing from now through the end of the year. Something else will spook the markets and will push yields lower and reopen the window of opportunity for TLT naked calls. Now that I’ve taken my profit on these calls, I can remain ready for the next opportunity to present itself.