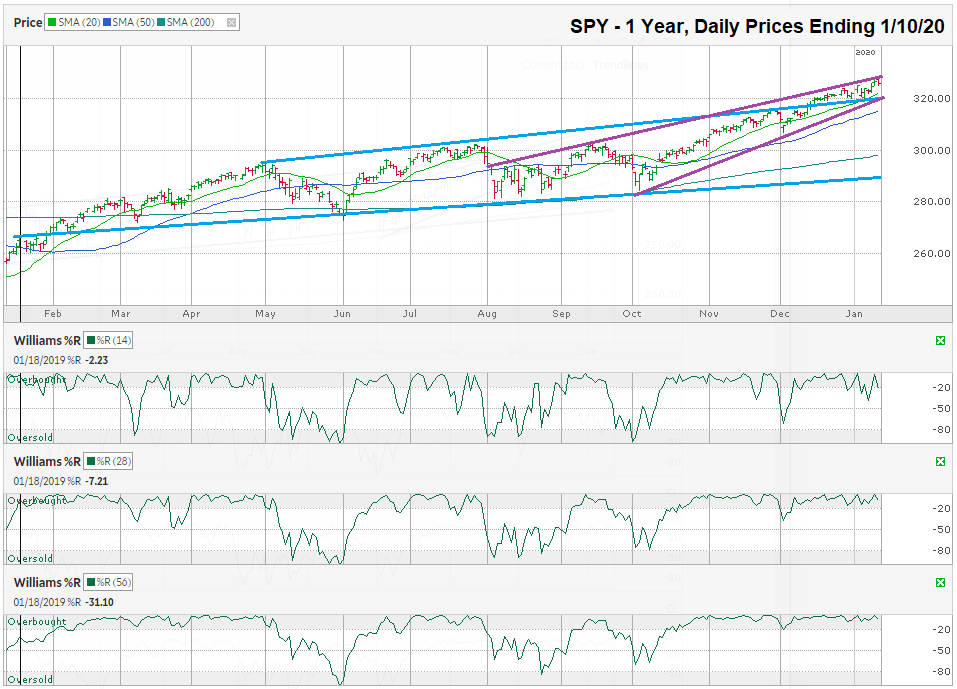

The chart below shows the daily prices for SPY, an S&P 500 ETF, after closing the week at $325.71 on January 10, 2020.

Last quarter, I pointed out the longstanding trading channel that was likely to offer support from the downside and suggested SPY would probably move back towards the upper trend line within this trading channel. Those lines are marked in blue and SPY remained in this trading channel for another two months until breaking through resistance at the upper trend line. That upper blue line that marks the trend line of higher highs is now offering support for stock prices. When a trend line that was resistance stops resisting the push to further highs, that line often becomes support to prevent lower prices. In other words, this upper blue line is likely to become the new trend line for higher lows.

The interesting test for this technical analysis will be how SPY behaves within the narrowing trading channel marked with purple lines. These lines have been converging slowly over the past few months with each high and low getting closer as the weeks pass. The expected pattern to follow an ascending wedge, according to textbook technical analysis, is for the breakout to be lower, not higher. Since the former trend line of higher highs (upper blue line) and the newer trend line of higher lows (lower purple line) are nearly equal, the probability of the outcome is less certain than it would be usually.

The benefit of this near-term uncertainty is that when a break in either direction happens, the probability of predictable price action improves for the following few weeks. If SPY falls below $320 within the next two weeks, the chances of a much deeper fall increases. Not only would the break below these two trend lines be sell signals, the 10-day moving average (barely visible in light green) would lose support also. Depending on how long it is before the ascending wedge breaks, the 20-day moving average (thin blue line) could also break support.

A break below these four technical indicators would leave a gap until $300 (the 200-day moving average) before this large-cap ETF could find technical support. Such a decline in prices would be close to a 7.5% loss in value for the S&P 500. Historically, 7.5% is part of a normal bull market’s min-cycles. A retest of the longer blue trend line would be close to an official “correction”, which is a price decline of at least 10%. This much of a pricing rebalance should be enough to bring buyers back into the picture and allow the bull market to resume.

The Williams %R indicator for has remained in the overbought section for most of the past three months with only one sell signal on November 27, when all three time frames reached 0.0. SPY only had three days of weakness after the sell signals triggered. Like every technical or fundamental indicator, the signals are not correct in every instance. However, after a false positive, the following signal is more reliable. This past Thursday showed a potential inflection point, but we won’t know until we see if these Williams %R indicators fall below overbought this week. If Williams %R line up with the trend lines and the moving averages, expect selling pressure to increase substantially.