Every so often when I start feeling some fear of the market’s potential demise I second guess some of the trades I’ve made. I look in on my Ameritrade account to see that I’m down on a few positions and depending on my overall mood I sometimes start to fear making another trade because I don’t want to make another mistake and loose more money. I’ve learned to take a closer look at the cause of my fear and examine my positions more closely.

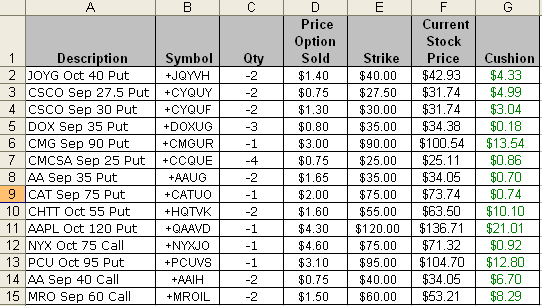

Just like I did last month in the middle of the month, I copied all of my options into a spreadsheet and figured out how bad my losses are right now (see below). This month illustrates the reason I run this drill. I have no positions I’m sitting on a loss on right now and didn’t even realize I was doing this well. I perform this analysis in most months and it’s one more of the many tools that keeps my head on straight and keeps the emotions out of my investing. This doesn’t mean that I’m going to run out and start trading my ass off, but it certainly helps me sleep better at night and allows for much calmer and more rational planning.

My holdings are sorted by time value remaining from least to most. The prices are as of the close on 9/10/07. The formulas are very simple and only used in column G. For the naked puts I used “=(F#-E#)+D#” and for the covered calls I used “=(F#-E#)+D#”, where “#” equals the row. I don’t include commissions for simplicity for this quick analysis.

Technorati Tags: naked puts, investing, stocks, options, covered calls, options strategies, trade, trading journal, trader’s journal, stock journal, finance

Good tool.

I sold all my QQQQ and SPY puts the other day when the market was down. I had invested about $9,000 and made over $1,800 in less than one week. Of course, risk was high on these September contracts.

My biggest problem right now still relates to my sanity too. Lack of solid journal, and unsurety of methods. Back in May of this year I was on a completely different path of buying good-name stocks and writing the covered calls and pocketing the premiums. However, my curiousity in the power of other option plays led me to request trading of options in my brokerage a little earlier than I had planned. Since then, I chose an out-of-character stock (ENCY) for unusually high percentage call premiums and lost money in the stock later. And, I traded ETFC options that tanked recently and lost money. These are my two main hits, lessons. Further, I opened a second brokerage, TOS, which now my Dad trades for me, since he showed higher success rate when he was paper-trading options. That leaves me still with my main account at E*Trade. I love covered calls, but have nearly decided to rotate money almost daily trading the QQQQ and SPY. As with any system, it will require discipline, which I told my wife takes out some of the “fun” I used to feel logging online to search, learn, and watch the market. But, you know, money must be its own reward, and I will certainly pass on if I’m able to focus on that objective and if trading the QQQQ and SPY works further. there is a nagging sense of loss from the summer, but right now what matters more is my going-forward plan, and stableness and consistency in all market conditions. I still admire greatly the put selling presented in this blog, and look forward to the day I choose to do some of that too. The percentages, as well as upward historical movement of the markets, indicate put selling is a winning situation, besides your own results proving it. I am tempted to say I’m bullish on the market from here to April, when the months usually post gains, but with all the recession talk and high oil and doggone subprime mysteries it’s a tough call. So I will use the futures each day as my first trading tip in the indexes. Well, this was very long today, but hope i don’t bore your readers too much…

Wow, $9k on the line to short the QQQQ and SPY and you timed it right. Congrats on those trades. It’s sick how fast you can make (or lose) money with options. You gave a great example of the power of leverage with options.

I think the reason I’ve stayed away from moves like you just did is my fear of losing just as fast. You made a 20% gain in a few days. You only need a few of those trades a year with only a small part of your portfolio to beat the indexes. Again, very impressive. Don’t worry, if you keep making returns like that, you’ll feel the “fun” of it.