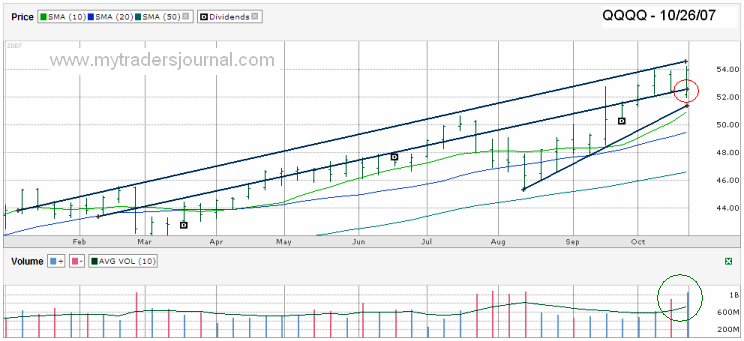

The last time I charted the QQQQ I was close to dead on. That’s been nearly two months so I figured I should try my luck again. This time I drew the weekly one year chart. Two months ago I said the QQQQ was due for a slight pull back before continuing its bull run. It pulled back that week to just below 48, I said I thought it would make it down to 47 at least. I also said I thought it would run back up to 55 next. It closed on Friday, October 26th, at 53.93, just below its recent high of 54.21.

The QQQQ is up this morning in pre-market, heading for the 55 range I predicted two months ago and the question remains if that’s still the top. While 55.00 certainly won’t be the exact top, I think we are due for another breather. Check out the point I circled in red. That circle shows where the trend line was broken last week to the downside before recovering. That flaw in the pattern to the downside, along with the return and stop just before the upper trend line, shows a likely ceiling.

The third line which starts at the August low shows the rapid accent that cannot be sustained over a very long period of time. I think that breaking point is near. We stayed above it last week, but can’t imagine that it holds that steep slope for much longer. Best case for the QQQQ is to ride that line all the way until it meets the upper trend line, but I’ll give that a 2% chance, based on My Trader’s Journal’s proprietary formula (picking a random low number that sounds convincing). If you are not reading this article on www.mytradersjournal.com you are reading it from a site that has plagiarized it.

The biggest difference between this chart and the QQQQ chart I drew last week is the volume. We actually had an above average volume week on an up week as opposed to the last time I was calling for a pull back. Based on volume, it might not be this week that the pull back comes. Seeing the QQQQ back down near 50-51 might be just what we need to shake out some froth which will create a great entry point for us to dive head first into technology stocks again.